Optimistic Rollup Network Report

By Tenderly | APR 11, 2024 - 13 min read

The Optimistic Rollup Network Report for Q1 2024 provides a comprehensive analysis of leading rollup networks such as Arbitrum, Optimism, and Base with a strong focus on the positive impacts of the Dencun upgrade. The Report explores the expansion of rollup frameworks and the rise of Rollup-as-a-Service (RaaS) providers that simplify blockchain deployments. It also evaluates Web3 development tools and infrastructure essential for network growth and developer support.

Developed in collaboration with:

Optimistic rollups saw a 10x increase in TVL and a 200% rise in TPS since early 2023.

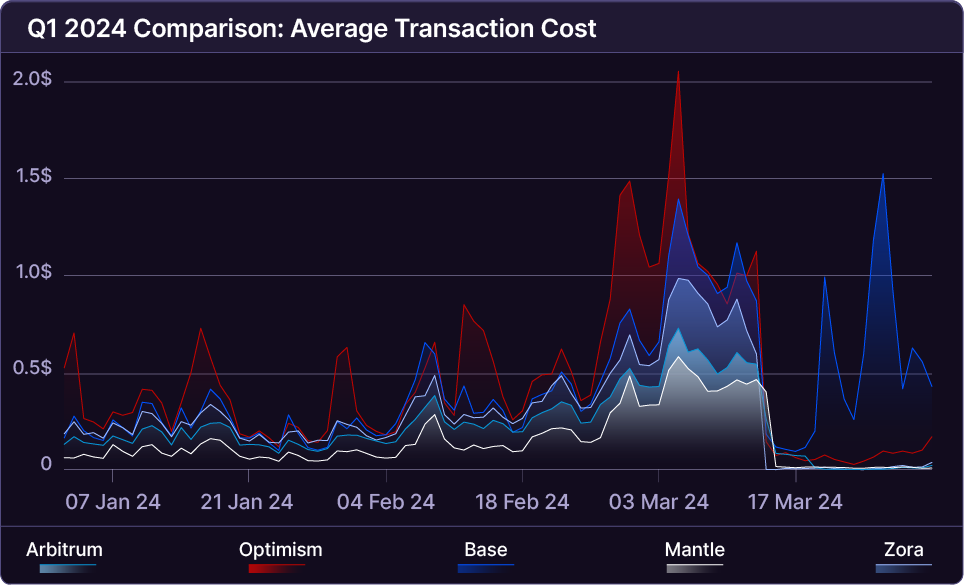

The Dencun upgrade reduced transaction costs by 90-98% on all optimistic rollups.

Arbitrum and Optimism have retained their first-mover and leading positions through innovative infrastructure solutions.

Base crossed 2M in the number of daily transactions, while Blast's TVL spiked past $1B.

The majority of development tools and infrastructure remain centred around Arbitrum, Optimism, and Base.

Rollup-as-a-Service providers are becoming indispensable partners, offering crucial services for the launch, maintenance, and scaling of rollup solutions.

New rollup networks, from general-purpose to application-specific ones, are being launched, with 10+ new optimistic rollups launched using optimistic tech stacks.

Mainnet vs. rollups post Dencun upgrade

Following the Dencun upgrade, there was notable growth in active addresses and transactions. The year observed a TVL jump from $4B to $17B, while Arbitrum and Optimism represented 80% of the total TVL.

The fastest growing optimistic rollups

The TVL in the sector surged to $40B from $20B at the end of 2023, driven by advances in the Web3 ecosystem and positive market trends. Optimistic rollups dominated Layer 2 solutions, peaking at a TVL of $30B.

ARBITRUM ONE

As one of the leading optimistic rollups, Arbitrum has seen significant on-chain activity over the past year. It was the first L2 to hit $1B in natively minted USDC. Tenderly recorded over 750K Forks created on the Arbitrum One.

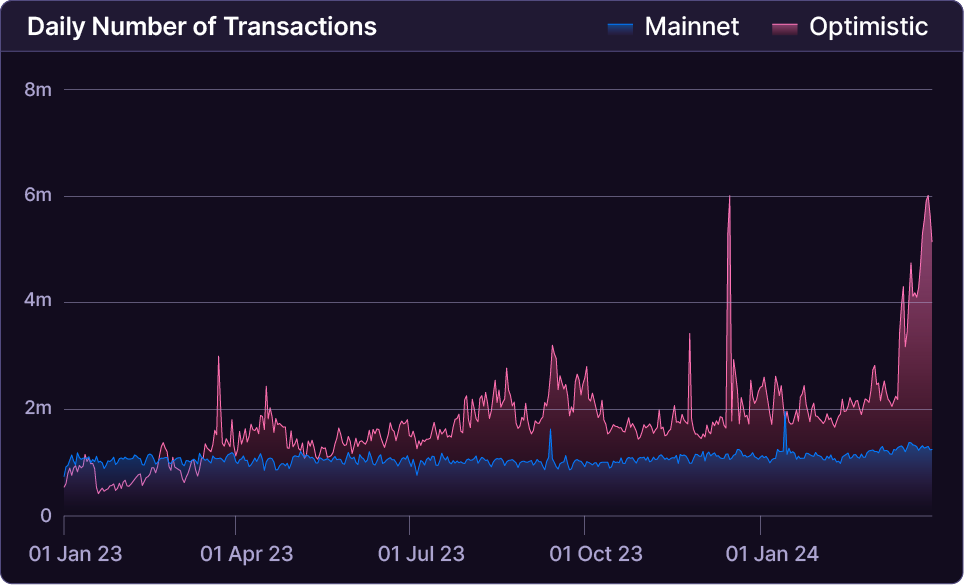

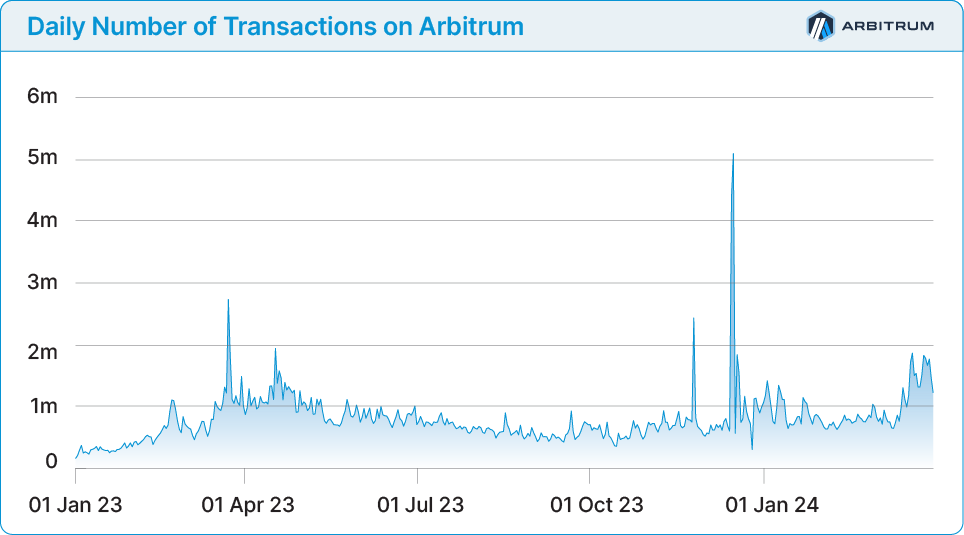

Number of Daily Transactions

Until the very end of Q1 2024, and the overarching Dencun upgrade benefits, Arbitrum was leading in the number of transactions among all other rollup solutions, crossing the number of transactions executed on the Ethereum Mainnet on more than one occasion. Peaks in activity on Arbitrum happened when $ARB token was launched and when Arbitrum kickstarted its STIP program.

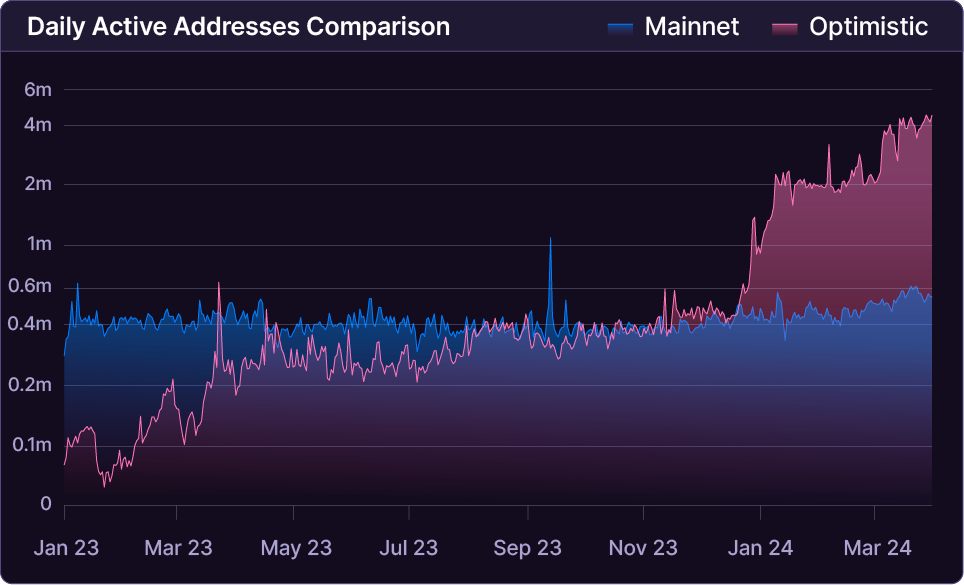

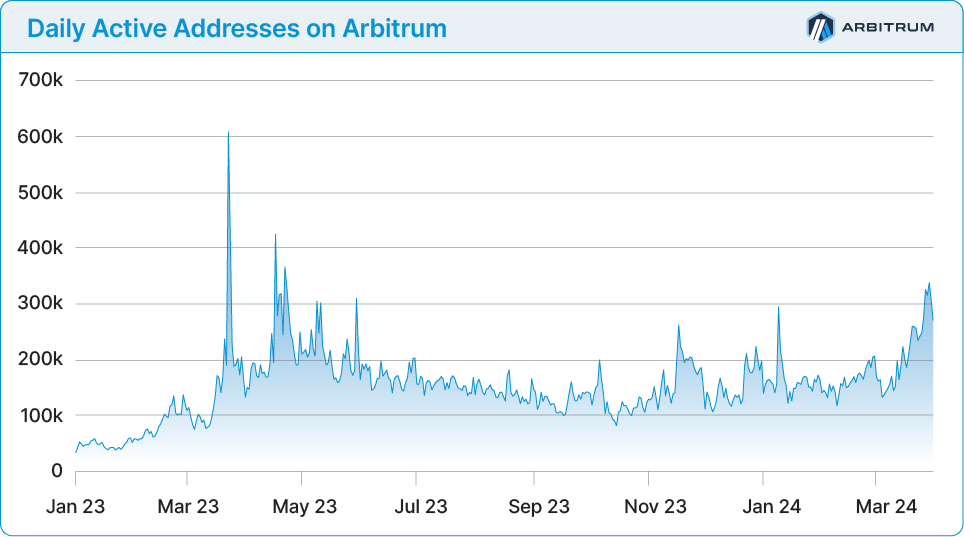

Daily Active Addresses

Throughout the previous year, Arbitrum was the optimistic rollup with the most active addresses. Though the metric isn't perfectly accurate in terms of number of users, since users can own more than one address, it's still an important metric giving insights into the user base and activity of a chain. As with the number of transaction peaks in numbers of active addresses were when Arbitrum launched its $ARB token, and $ARB incentive programs.

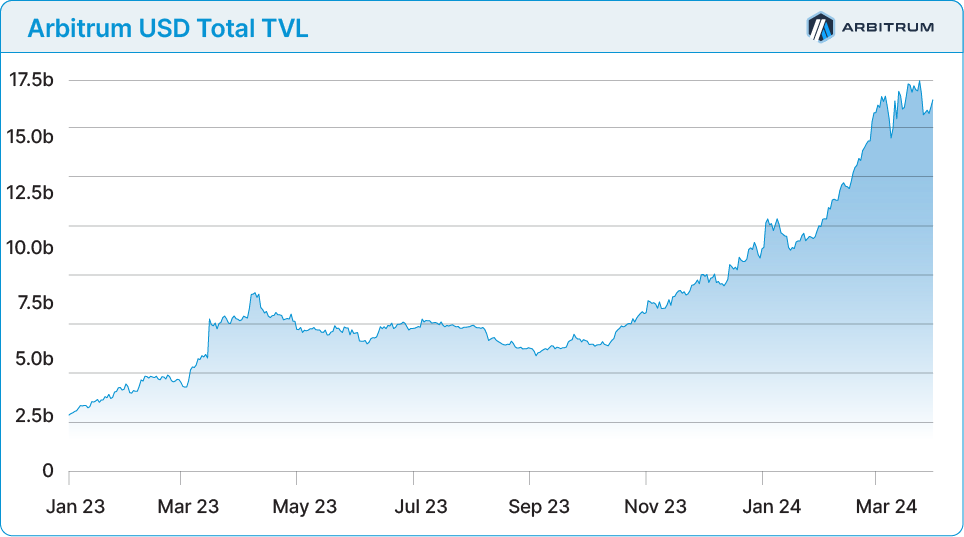

Total Value Locked

According to the L2BEAT methodology of tracking the Total TVL of rollups, summing all canonically bridged, externally bridged, and natively minted tokens, and converting them to USD, Arbitrum One's leading position among other optimistic rollups seems firmly established, accounting for over 40% of the total optimistic market share.

OPTIMISM'S OP MAINNET

Optimism's OP Mainnet became one of two leading rollup solutions for the Ethereum network, and of the key DeFi ecosystems due to its low transaction fees, developer incentive programes, and focus on decentralized and open-source approach. Tenderly recorded over 17M Web3 Actions executed on OP Mainnet.

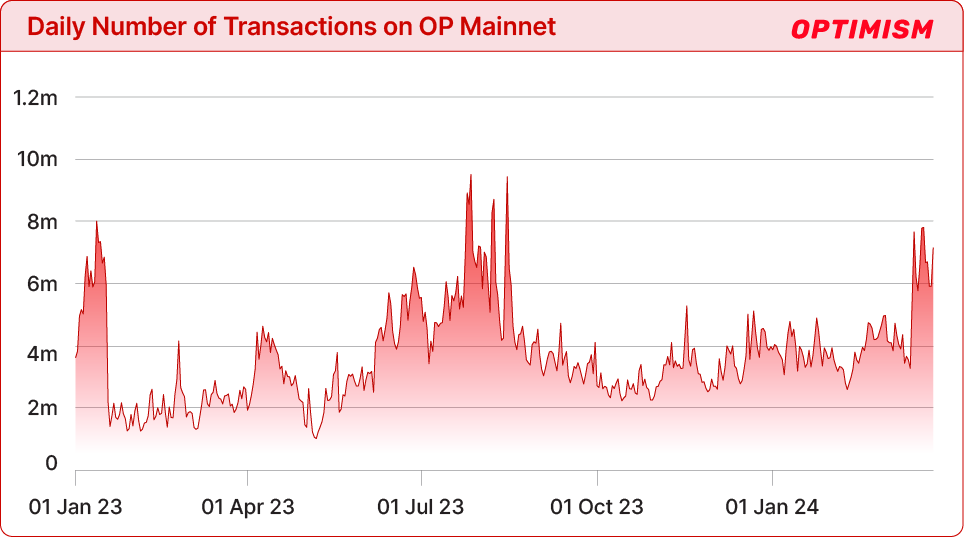

Daily Number of Transactions

The peak in activity on Optimism's OP Mainnet seems to coincide with the launch of Base and Optimism's participation in the Onchain Summer campaign which drew significant number of users across the Optimism ecosystem. The chart showcases the swift rise in transaction number following the Dencun upgrade.

DeFi Total Value Locked

The total value locked of decentralized finance applications of Optimism's OP Mainnet offers a glimpse into a gradually growing DeFi ecosystem with fairly consistent usage metrics across the board, though a big chunk of Optimism's overall TVL is now redistributed across the Superchain ecosystem.

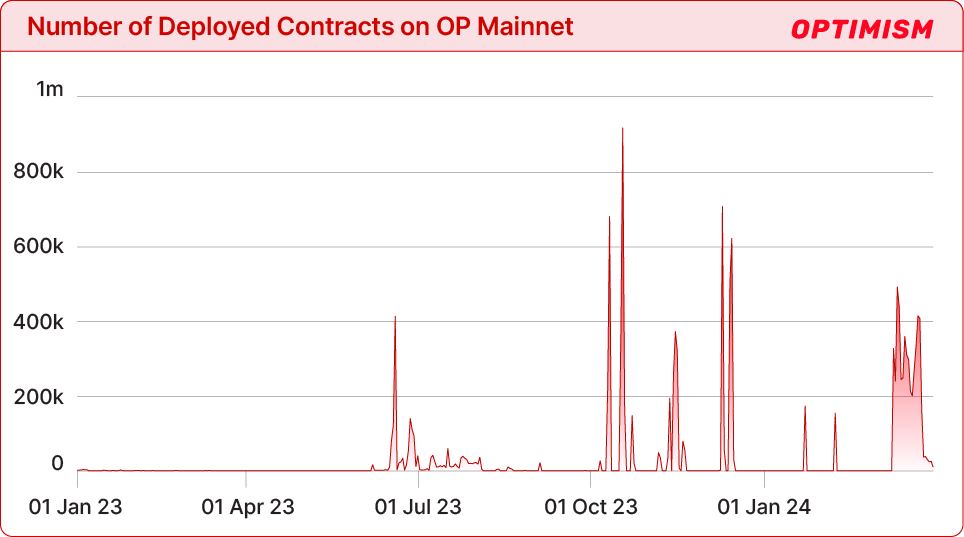

Deployed Contracts

Optimism's primary network saw a significant growth in the number of developers, builders, projects launched and altogether number of deployed contracts. Optimism's overall ecosystem now has two core contributing teams from both Optimism Collective and Base improving on the codebase.

opBNB

opBNB functions as a scaling solution for the BSC ecosystem. Built using the OP stack, opBNB is interoperable with other L2 rollups also built using the stack, such as Optimism, Base, and many others.

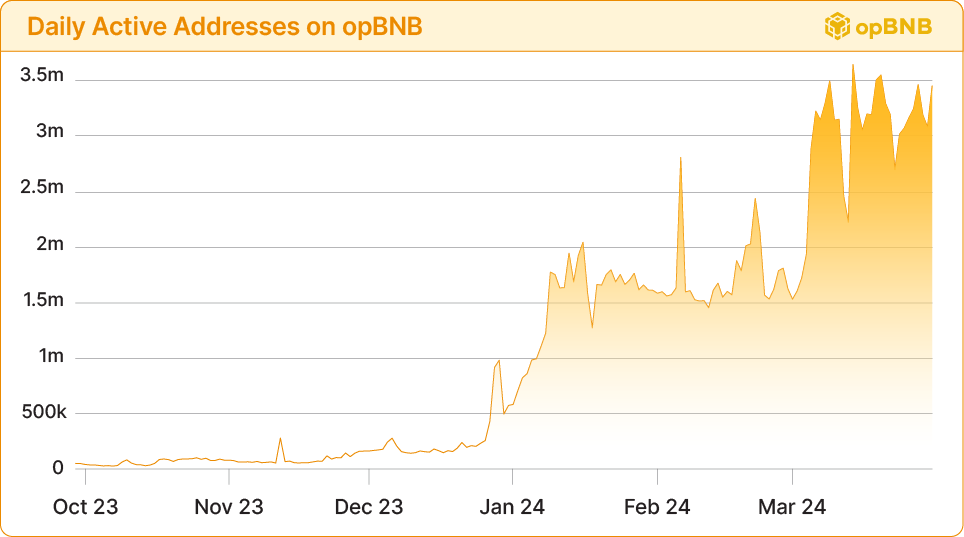

Daily Active Addresses

As a Layer 2 solution and rollup of the BSC (BNB Smart Chain), opBNB is helping scale the Binance network. The meteoric rise in the number of active addresses can be attributed to opBNB extending the activity of BSC and sharing a great number of dapps with the parent chain. Official opBNB explorer data.*

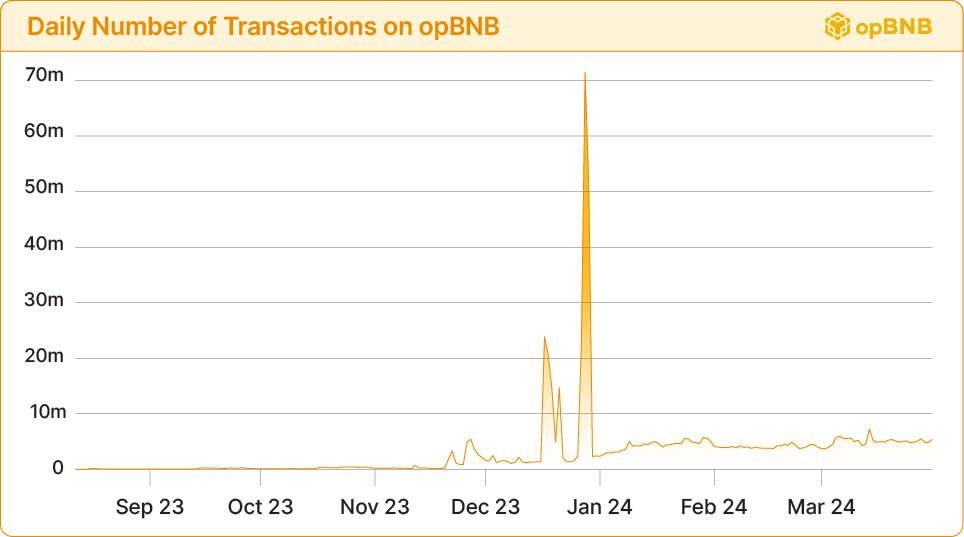

Daily Number of Transactions

In general there is a high volume of activity on opBNB network. Spikes in activity can probably be attributed to testing the networks’ capabilities. Official opBNB explorer data.*

Transactions Per Second

opBNB recored a significant spike in its throughput on more than one occasion at the end of 2023. As with the number of transactions, this can probably be attributed to testing the networks’ capabilities. Official opBNB explorer data.*

BASE

Base is the first Layer 2 optimistic rollup built on top of Ethereum using the OP stack. This rollup is EVM-equivalent with focus on security, scalability, and stability, while providing many times lower transaction fees. Tenderly recorded over 11M Alerts sent on Base.

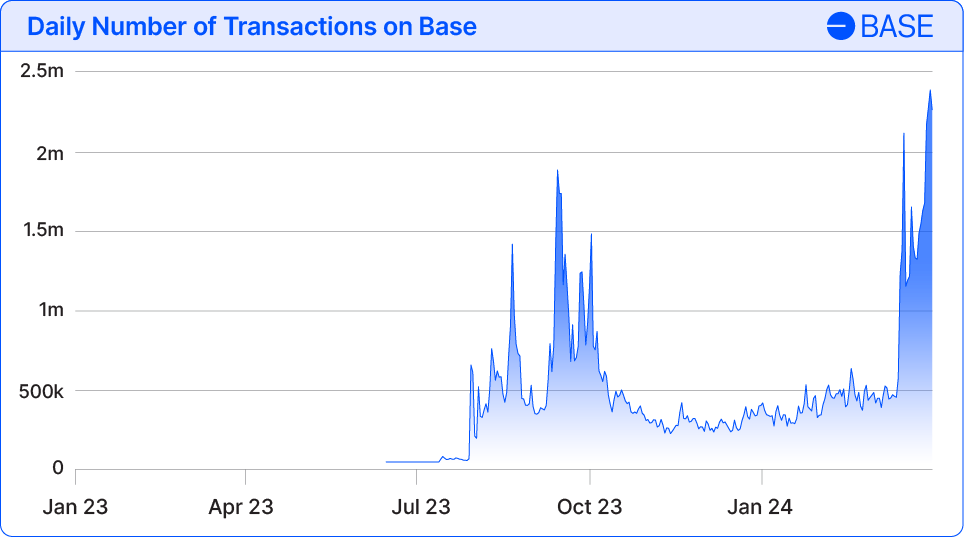

Daily Transactions

The increase in the number of daily active addresses, the ever-growing number of token pairs, and a sprawling NFT ecosystem consistently increased the number of transactions, breaching 1M daily transactions and 2M at the end of Q1.

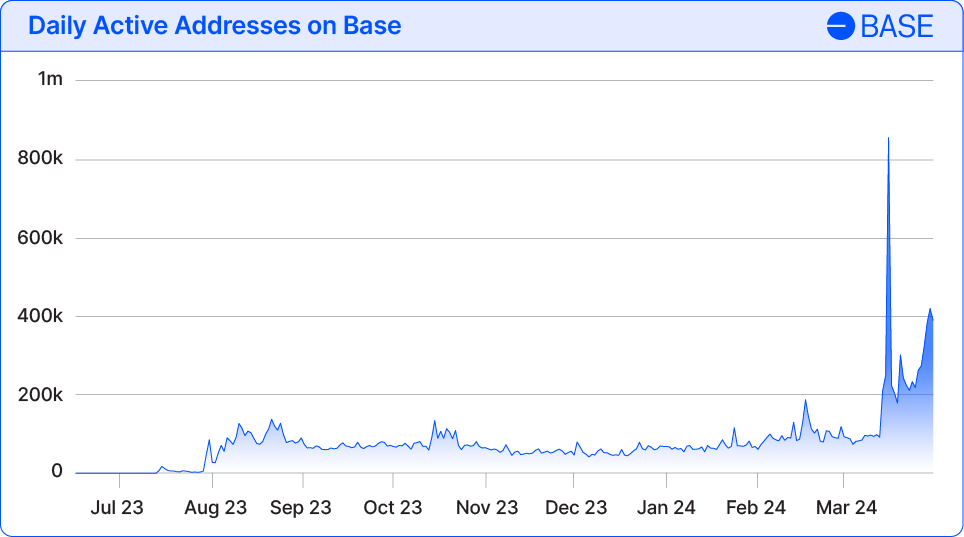

Daily Active Addresses

Riding the wave of increased user adoption, Base crossed $1B in TVL at the end of Q1 2024. The impact of the Dencun upgrade was most evident in the case of Base. The number of users or daily active addresses on the rollup surged from 60K on average to over 200K every day since the upgrade, spiking even above 800K. Though the network is growing, some percentage can be probably attributed to farming bots and multiple accounts from a single user.

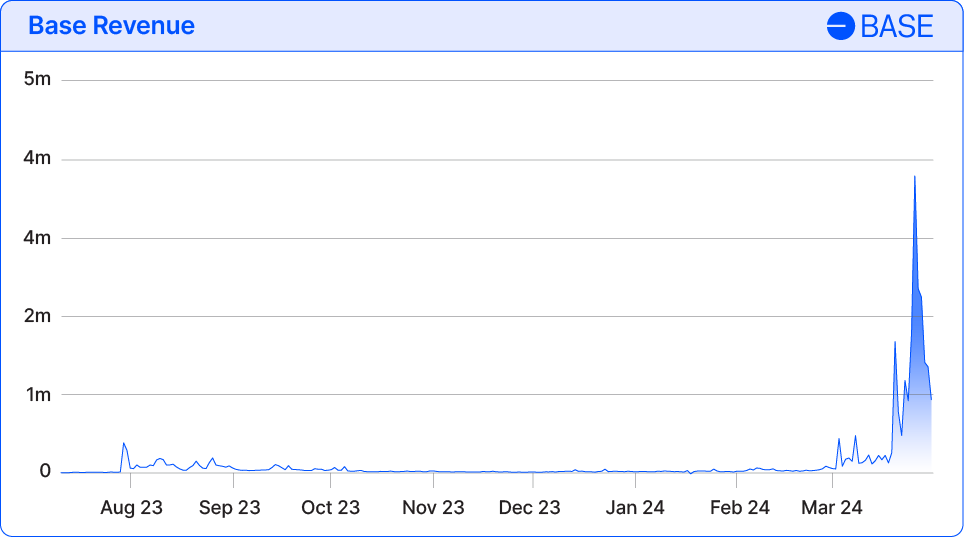

Daily Revenue

Base is currently the most successful revenue-generating rollup network with over $40M in revenue, a profit margin ratio of 0.64 and total profits of around $28M. Following the Dencun upgrade, Base saw a significant increase in the number of revenue-generating contract deployments.

MANTLE

Mantle enhances Ethereum scalability significantly, offering cost-efficient transactions, increased transaction throughput, and reduced latency. It currently has $270.96M in TVL. Tenderly recorded over 15K transactions monitored on Mantle in Q1 2024.

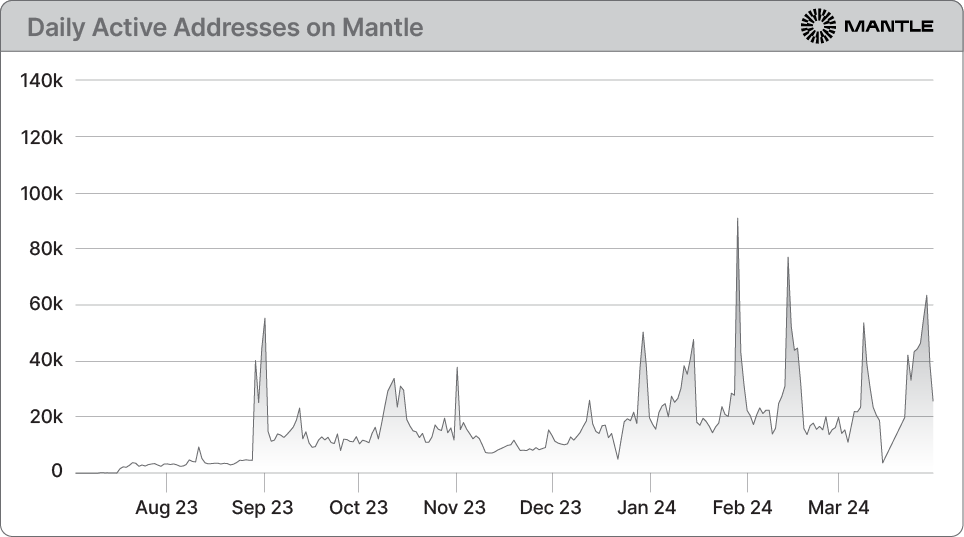

Daily Active Addresses

Though not large in numbers, the number of active users on the rollup has held steadily since its launch with occasional spikes in activity.

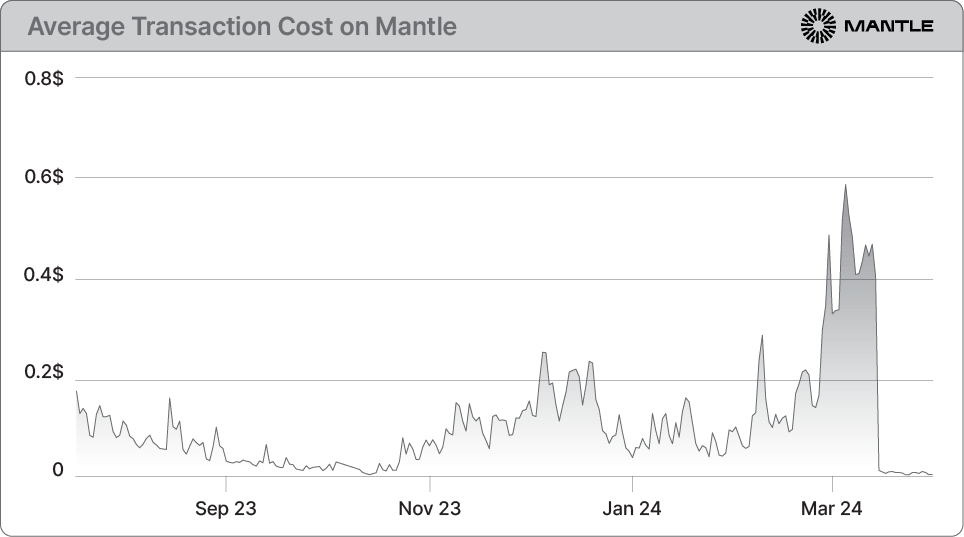

Average Transaction Cost

Since its launch, Mantle network’s transaction costs have remained consistently low, despite it’s growing DeFi ecosystem. After spiking at the start of the year, fees on Mantle have drastically decreased to bellow $0.02, dropping even bellow $0.01, making the network more appealing.

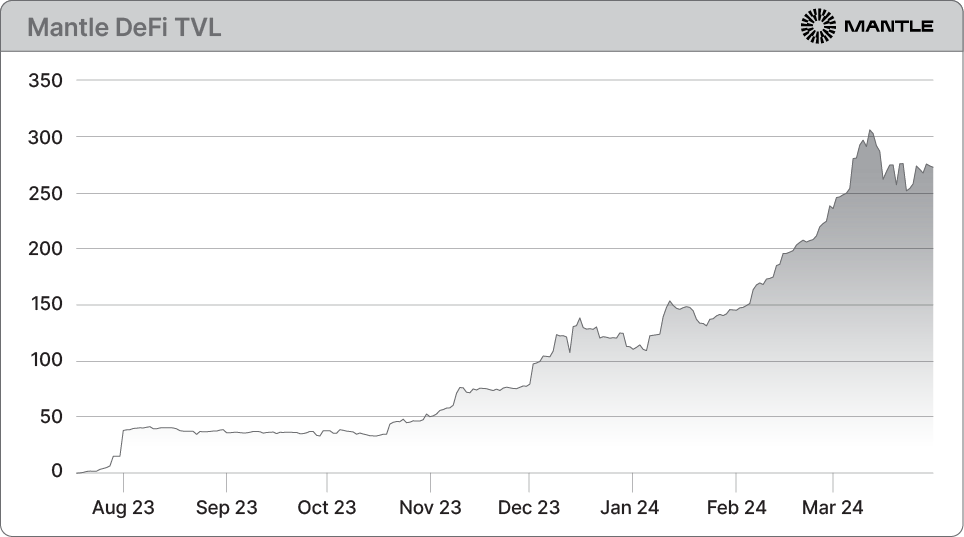

DeFi Total Value Locked

With an ever increasing number of DeFi dapps being launched on Mantle, it’s no wonder that the DeFi TVL on the network is consistently growing, according to DeFiLlama.

ZORA

Zora network is the first NFT-focused Layer 2 optimistic network built using the OP stack. Following the Dencun upgrade, transaction costs on Zora are now less than $0.02, making Zora one of the biggest benefactors of the rollup-centric update. Tenderly recorded over 30K simulations executed on Zora.

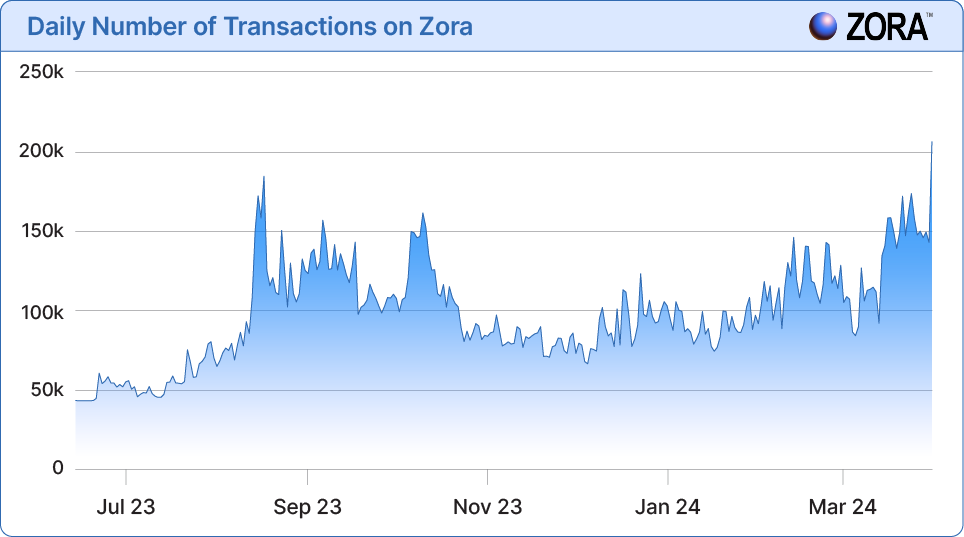

Daily Number of Transactions

Following the Dencun upgrade, the daily number of transactions on Zora crossed 200K for the first time at the end of March 2024. Zora usage on-chain metrics have steadily risen since the start of the year. The transaction costs on the network have substantially decreased, dropping from $0.1-0.7 to less than $0.02, making Zora one of the biggest benefactors of the rollup-centric update.

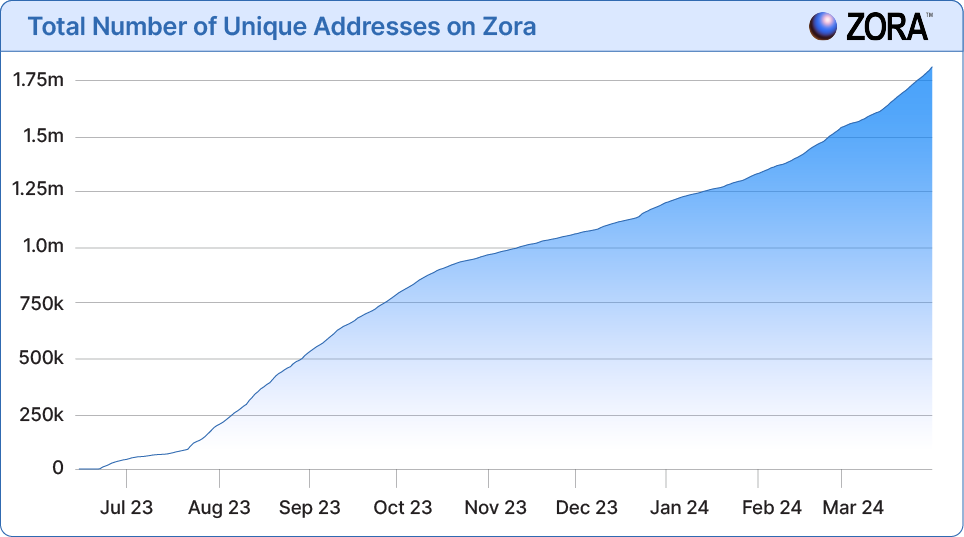

Total Unique Addresses

Zora network is going through stable and consistent growth in the total number of active creators. The daily number of active addresses is on the rise since the start of the year, recording a significant increase following the Dencun upgrade. Since the upgrade took place, fees on Zora have dropped bellow $0.01 making its NFT ecosystem the biggest benefactor among optimistic rollups.

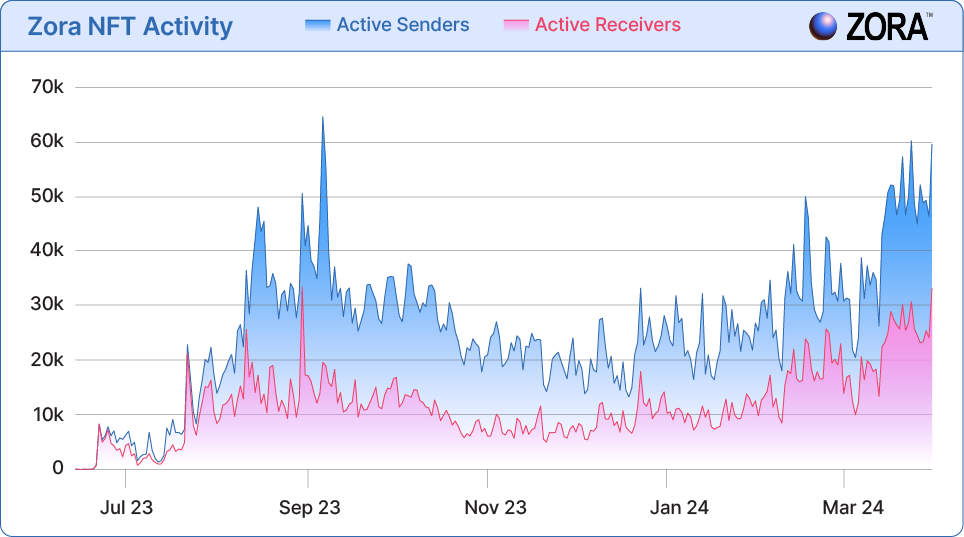

NFT Activity

Creators are creating and sending new NFTs on Zora fairly consistently since the network’s launch. Going beyond the general metric of active addresses, both the number of active creators and the number of collectors is expanding, especially after the Dencun upgrade.

BLAST

Blast is a Layer 2 optimistic network built on top of Ethereum, launched by the team that achieved success with Blur, one of the most popular NFT marketplaces. Blast incentivizes dapp developers by distributing 100% of gas fees revenue. Tenderly recorded over 10K Forks created on Blast since its launch.

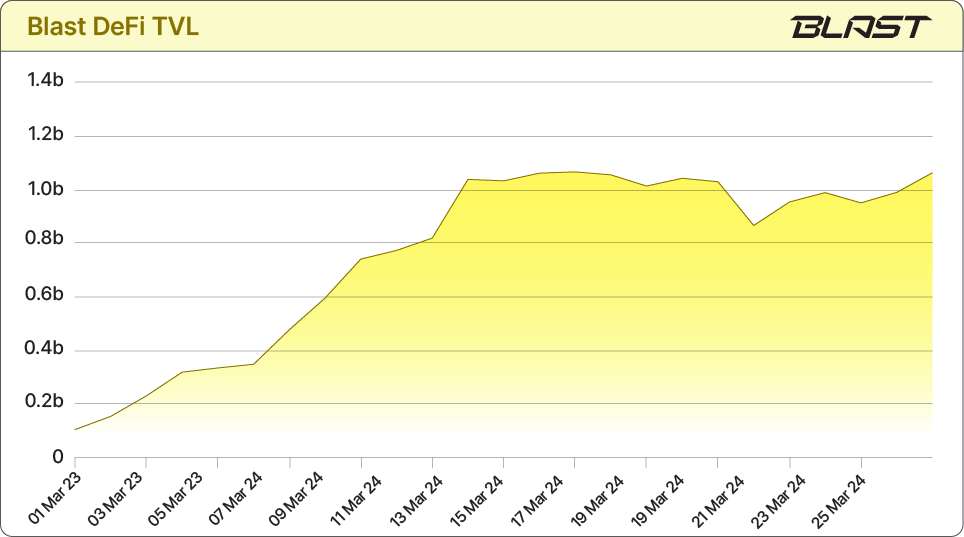

DeFi Total Value Locked

Blast's DeFi ecosystem is rapidly growing given the fact that the optimistic rollup network was officially launched a month ago. Numerous DeFi protocols have launched in their bid to try and capture a part of Blast's impressive amount of bridged TVL.

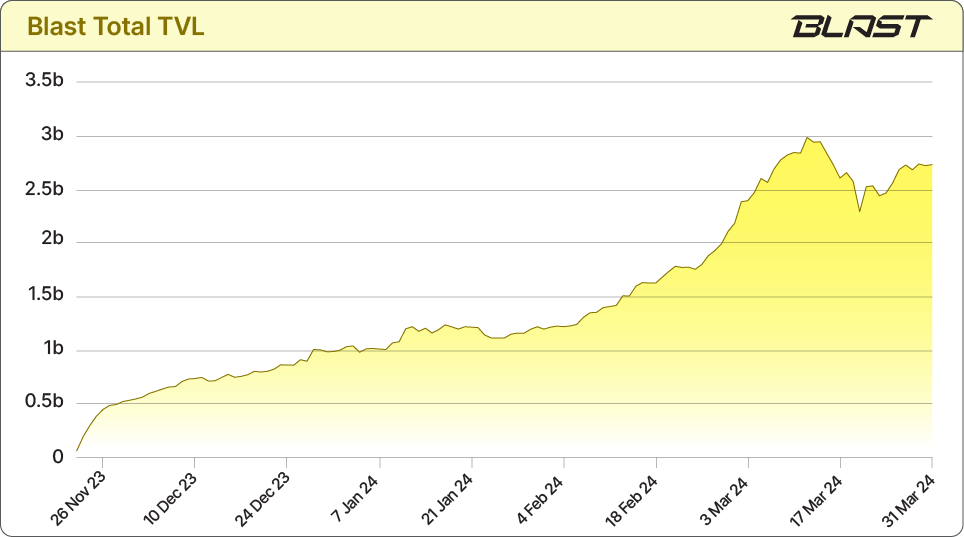

Total Value Locked

In Novemer 2023, Blast enabled the bridging of assets to the yield network, via a series of incentive campaigns, including the promise for an airdrop. According to L2BEAT, over 75% of total assets on the Blast network were canonically bridged since bridging was enabled. The rest is divided among the many recently launched dapps offering new and innovative yield opportunities.

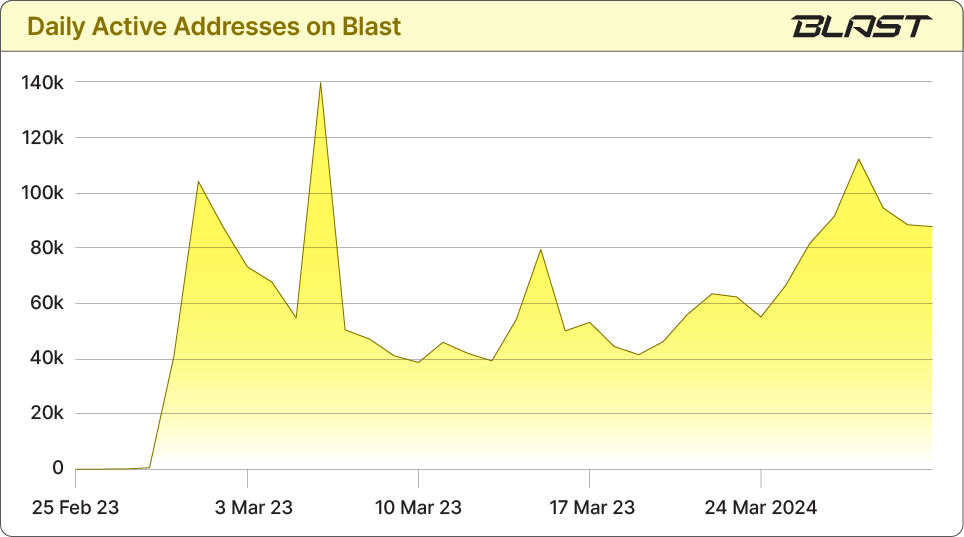

Daily Active Addresses

With the Blast network launching at the end of February 2024, users that bridged their assets in the months before the mainnet launch were able to make use of their assets as Blast’s DeFi dapp ecosystem sprang with the Spring of 2024.

Developer tools and infrastructure providers for optimistic rollups

Tooling availability is one of the key indicators of growing rollup network capable of accommodating developers' needs. Below is a list of essential developer tools and infrastructure providers broken down by the networks they support.

|

|

|

|

|

|

|

|

|

|---|---|---|---|---|---|---|---|---|

| Tenderly | ||||||||

| Chainlink | ||||||||

| Gelato | ||||||||

| Thirdweb | ||||||||

| The Graph | ||||||||

| Metamask | ||||||||

| 0x | ||||||||

| Quicknode | ||||||||

| Ankr | ||||||||

| Chainstack | ||||||||

| Infura | ||||||||

| Blockscout | ||||||||

| LayerZero | ||||||||

| Li.Fi | ||||||||

| Axelar | ||||||||

| Instadapp | ||||||||

| Dune | ||||||||

| Safe | ||||||||

| Zerion | ||||||||

| Hardhat | ||||||||

| Foundry | ||||||||

| Alchemy | ||||||||

| Scaffoldeth | ||||||||

| Openzeppelin | ||||||||

| Moralis | ||||||||

| Blockdaemon | ||||||||

| Blockjoy | ||||||||

| Getblock | ||||||||

| Pokt | ||||||||

| Allnodes | ||||||||

| Nownodes | ||||||||

| Enso | ||||||||

| Goldsky | ||||||||

| Nodereal | ||||||||

| Hyperlane | ||||||||

| Flair |

Final thoughts: Cautious optimism

The Ethereum community's adoption of a rollup-centric roadmap, highlighted by the Q1 2024 Dencun upgrade, underscores its commitment to solving the blockchain trilemma and supporting a multichain future. This approach is proving effective in improving user experience by making onboarding cheaper and more accessible.

Optimistic rollups have seen the most benefits from the upgrade, including reduced transaction costs and increased transactions per second, user numbers, and TVL. The enhancement in developer tools and the emergence of new technologies and partnerships are driving the evolution of optimistic rollups, making them easier to launch, with better support and user experience.

Legal disclaimer

This report contains data for informational purposes only and is not intended to provide financial or legal advice. The information is based on our internal sources and network analysis. However, it also contains information collected from publicly available resources for which we cannot guarantee completeness or accuracy. We strongly advise you to conduct your analysis and research as this report does not assure any future results or performance.