2023 EVM Network Landscape Report

By Tenderly | DEC 20, 2023 - 13 min read

The EVM Network Landscape report gives an overview of the most widely used Ethereum scaling solutions, such as L2s and appchains, and their role in shaping the multichain future of blockchain technology. This report dives into the on-chain activity signaling the growing popularity of scaling solutions, as well as the availability of tools and infrastructure components supporting their adoption and developer onboarding.

READ FULL REPORTA multichain system of independent networks and appchains benefits Ethereum’s scalability, ecosystem resilience, growth and innovation, and blockchain adoption.

Key data shows increasing on-chain activity on Optimism, Arbitrum, Polygon, BNB Chain, Avalanche, and Base for chain-specific use cases.

OP Stack, Polygon zkEVM, and Avalanche Subnets offer ready-made components that facilitate and accelerate new L2 and rollup deployments.

Tooling and infrastructure availability on the chains listed in the report points to their developing ecosystems.

A growing number of providers offer their services on ecosystem networks and appchains, underscoring the importance of multichain support.

While Ethereum TVL surpasses TVL on individual L2 networks, the aggregate value of L2 TVL is much higher than on Ethereum.

Which ecosystem networks show an increase in on-chain activity?

The 2023 EVM Network Landscape Report analyzes on-chain activity on the following ecosystem networks: Optimism, Arbitrum, Polygon, Avalanche, BNB Chain, and Base as an up-and-coming solution

OPTIMISM

Based on optimistic rollup technology, Optimism is an L2 solution with a crucial role in addressing Ethereum’s scalability challenges. By processing transactions off the Ethereum chain, Optimism enhances the network's capacity to handle a larger number of transactions more efficiently and at a lower cost.

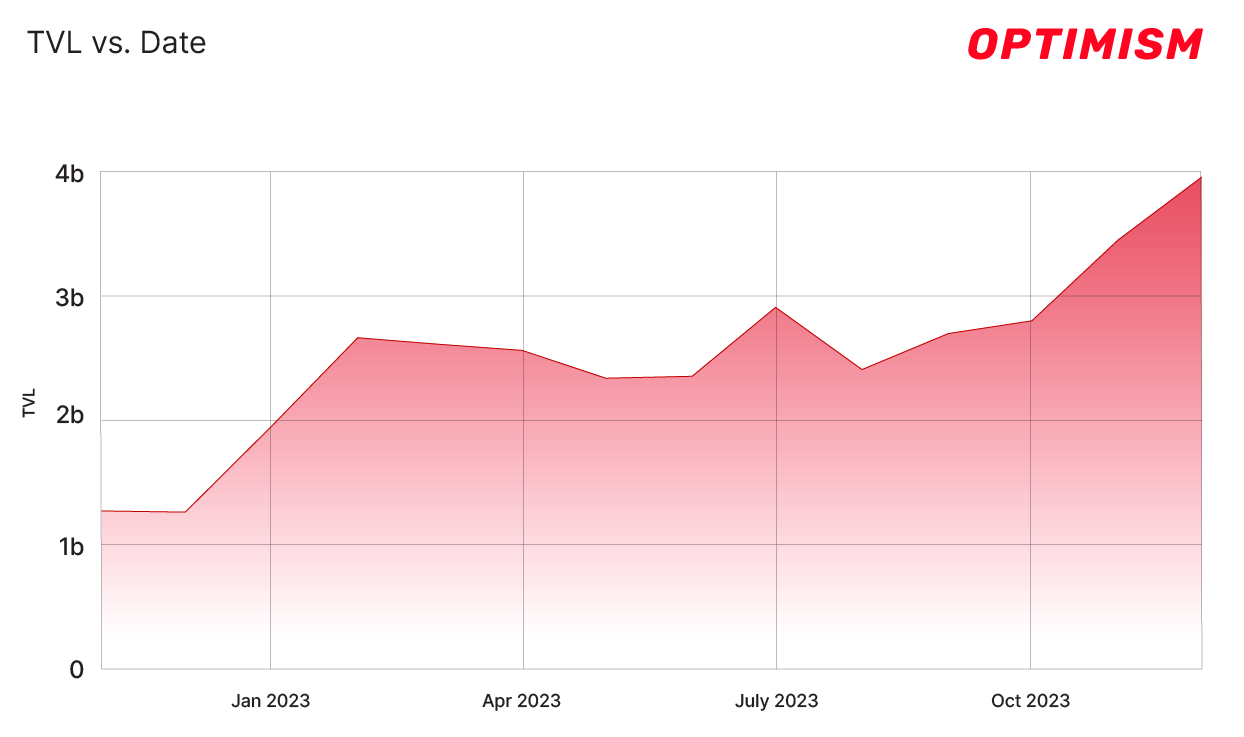

Total Value Locked (TVL)

Optimism's TVL has seen a remarkable increase, soaring from just below one billion dollars to approximately four billion dollars in just over a year. This substantial growth in TVL indicates a growing trust in the network and an increase in the amount of assets being managed on the chain. Such a spike reflects the network's expanding utility and adoption within the decentralized finance (DeFi) space.

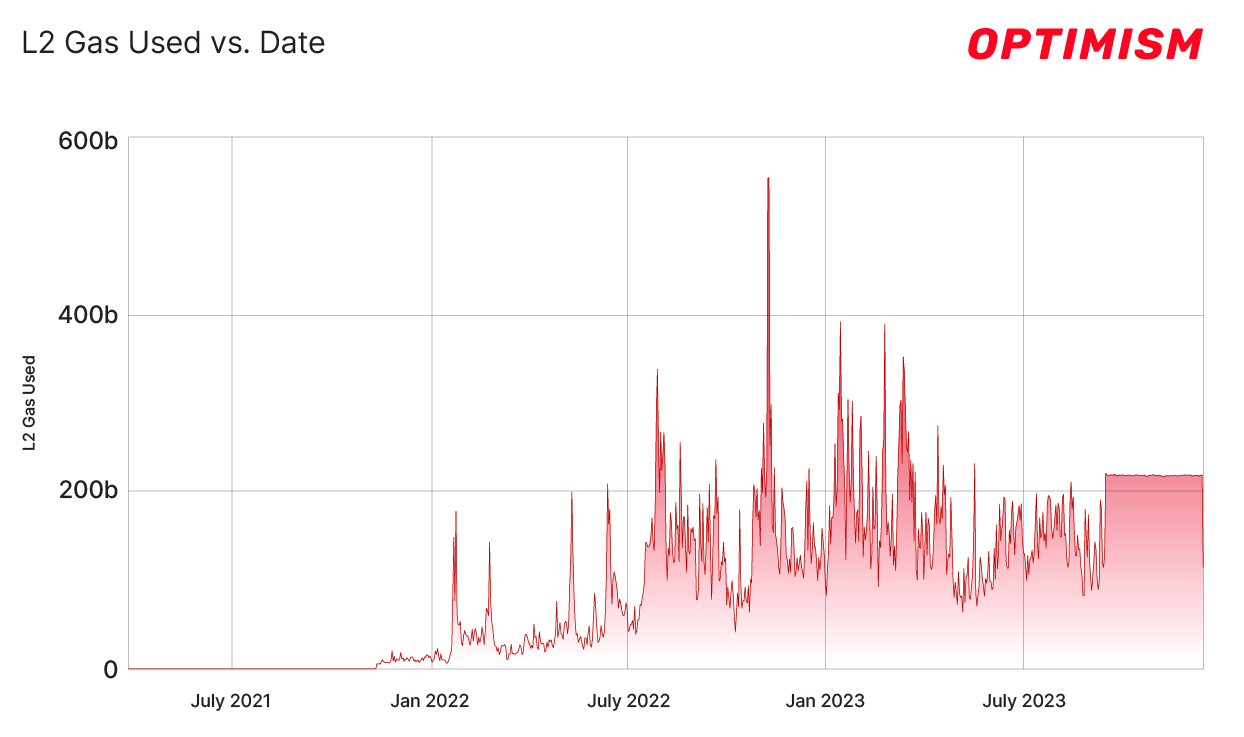

Gas consumption

The consistent increase in gas consumption on Optimism points to the growing complexity and volume of transactions being processed on the network. This trend suggests that users and developers are actively engaging with more sophisticated applications on Optimism, leveraging its scalability benefits. The rise in gas consumption is a direct indicator of the network's capability to handle a high volume of complex transactions efficiently.

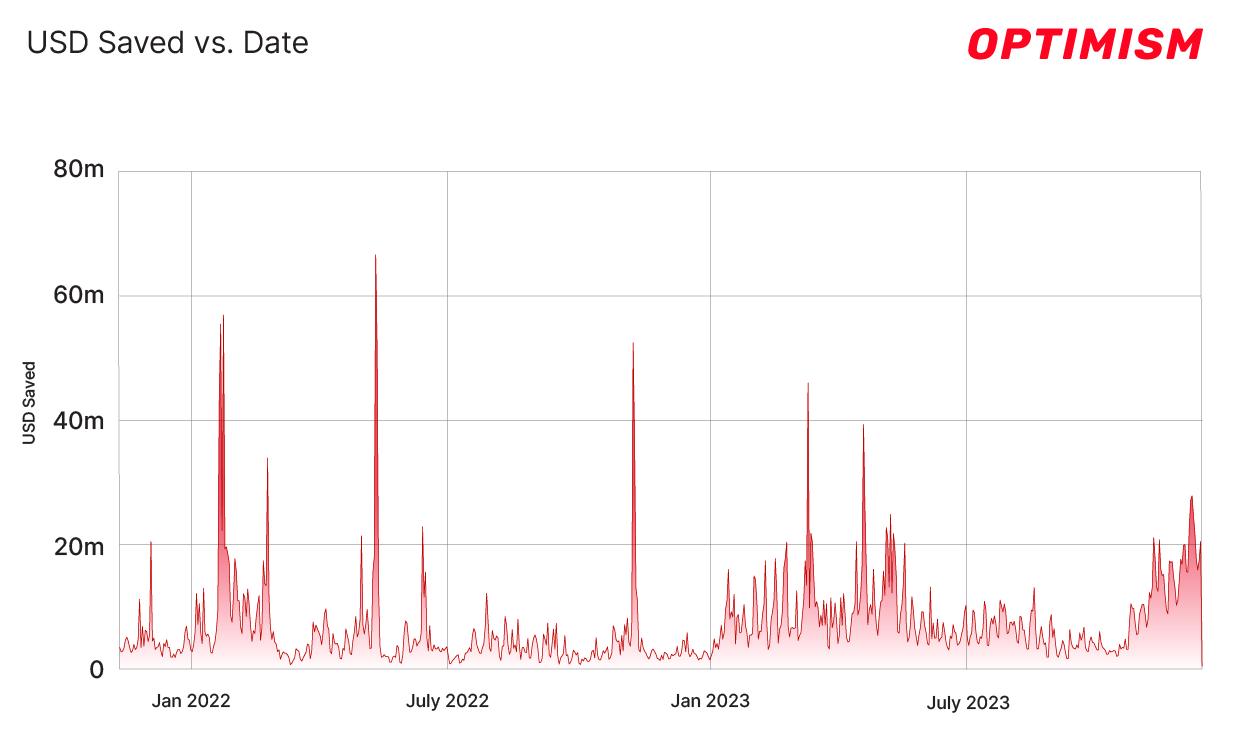

Cost savings

One of Optimism’s most significant impacts is the considerable cost savings it offers. By processing transactions on Optimism instead of Ethereum Mainnet, users have reportedly saved an impressive 20 million dollars per day in the last month. This figure highlights the economic efficiency of using Optimism, especially in terms of reduced transaction fees compared to those on Ethereum. The cost-effectiveness of Optimism makes it an attractive platform for users seeking to execute transactions more affordably.

ARBITRUM

Arbitrum has emerged as another essential solution for scaling the Ethereum network. Thanks to the use of optimistic rollups, this L2 solution enables faster, more efficient transactions, facilitating broader adoption and more sophisticated applications in the blockchain industry.

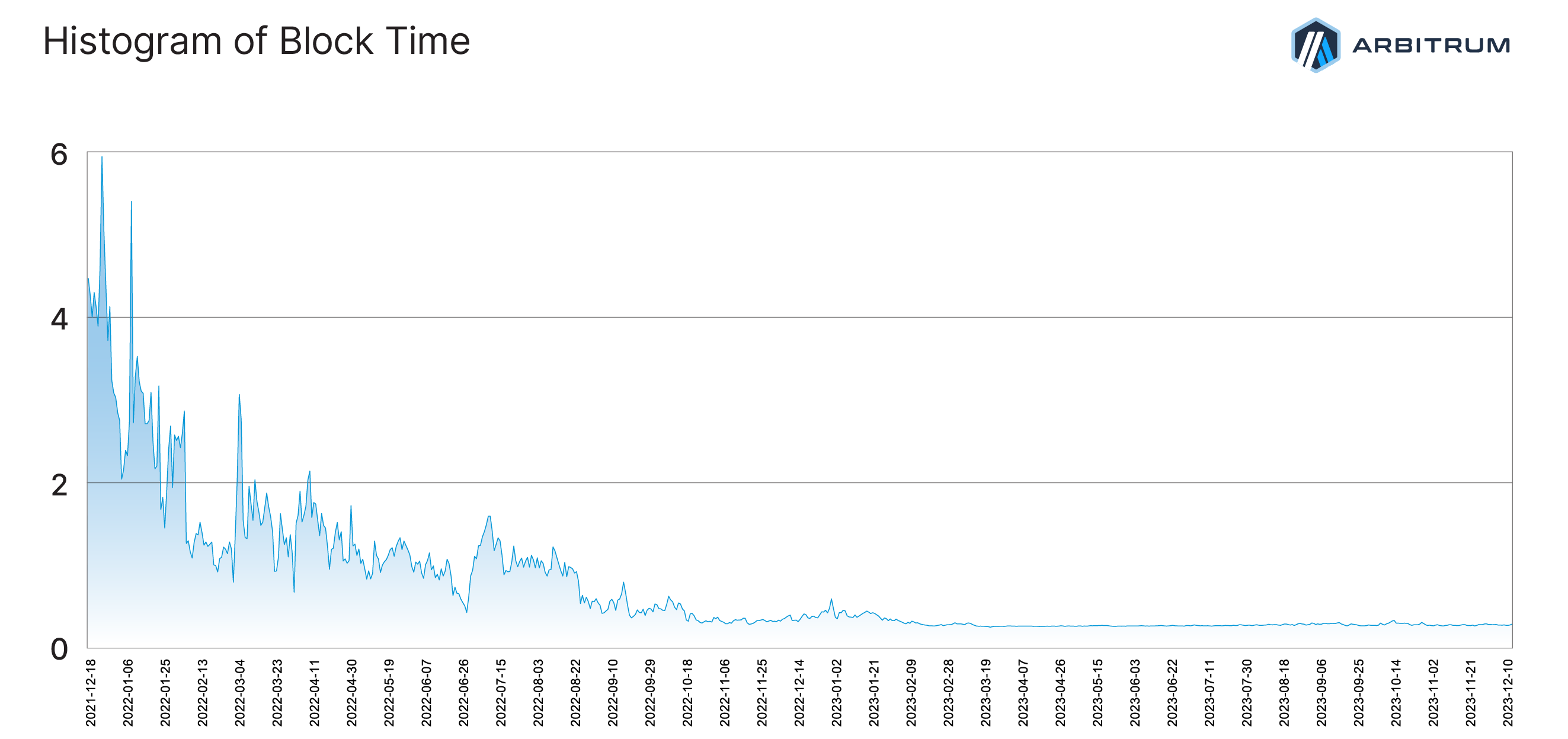

Fast block time of 250ms

Fast block time of 250ms: Arbitrum's extremely fast block time of 250 milliseconds significantly accelerates transaction processing, making it comparable to traditional Web2 experiences. Such fast block time is crucial for real-time applications, offering users a seamless and responsive experience vital for the adoption of blockchain technology in mainstream applications.

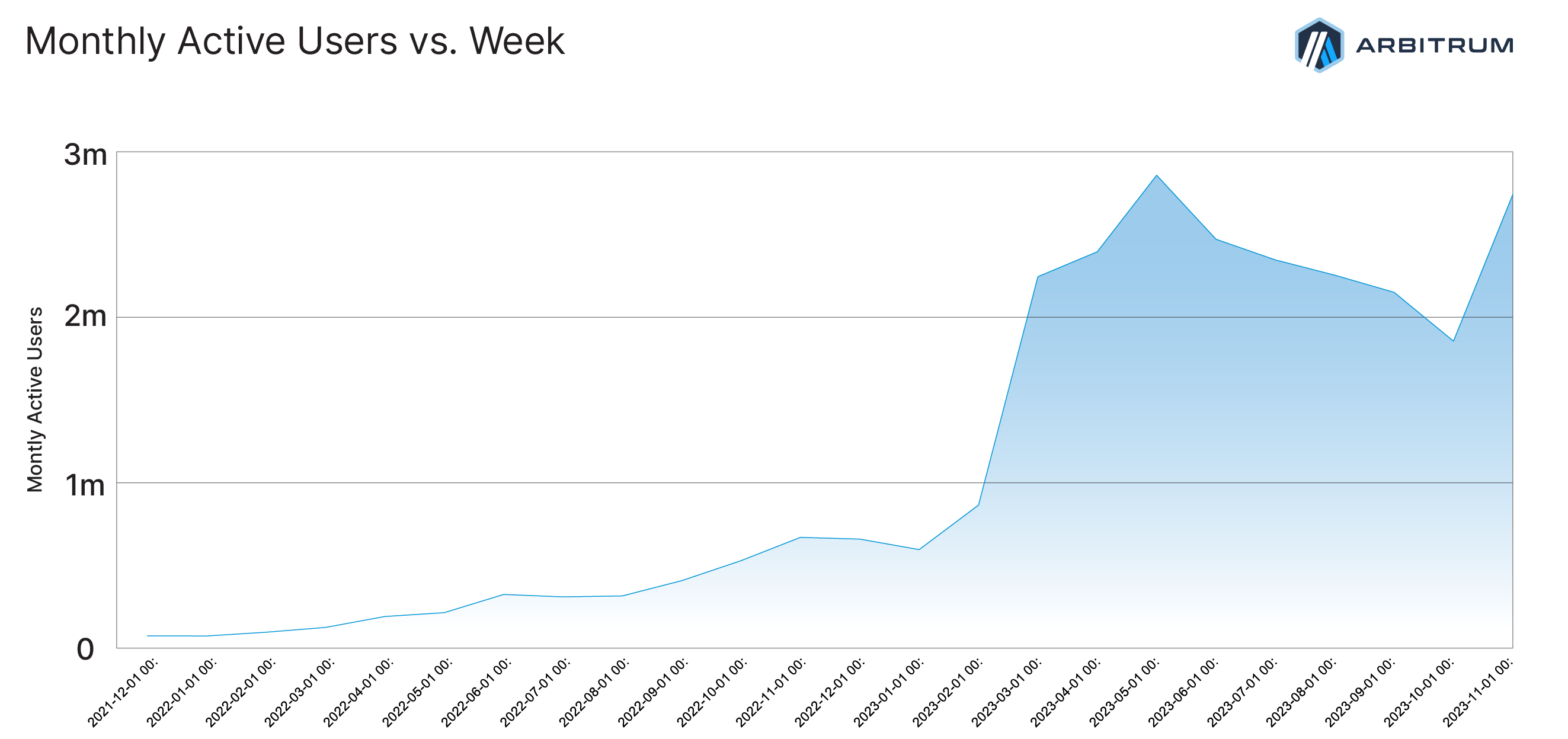

Significant growth in MAU

Arbitrum’s monthly active users have increased by 8 times over one year. This metric indicates the growing popularity and trust in Arbitrum's capabilities. However, this eightfold increase also points to a healthy, vibrant ecosystem that is attracting a diverse range of participants.

Robust Total Value Locked (TVL)

Arbitrum’s TVL incorporates native currencies as well as assets bridged from other networks. The continuous and significant TVL growth signifies a strong and liquid market presence, indicating the confidence of investors and users in Arbitrum. A rising TVL is also indicative of a thriving ecosystem, demonstrating Arbitrum's capacity to support a wide array of dapps and financial protocols.

POLYGON

Polygon has been making significant strides in enhancing user experience on its network, with a focus on ease of use, cost-effectiveness, and technical innovations. With over 100 decentralized applications and service providers, it has a thriving ecosystem of both developers and end users.

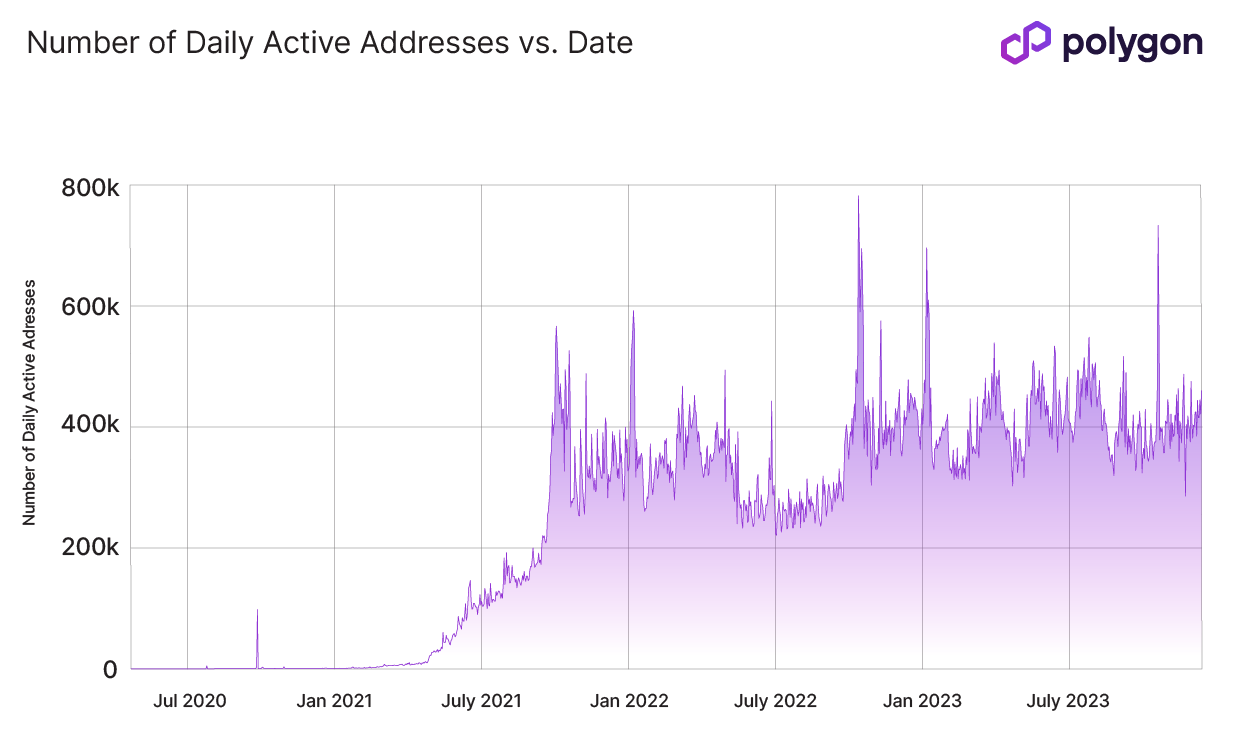

Daily active addresses

Polygon's network activity indicates its high user engagement. Regular updates, technical improvements, and a focus on user-centric features contribute to maintaining and growing its active user base. The network has been consistently improving its infrastructure to handle a high volume of transactions, catering to a diverse range of applications from gaming to DeFi.

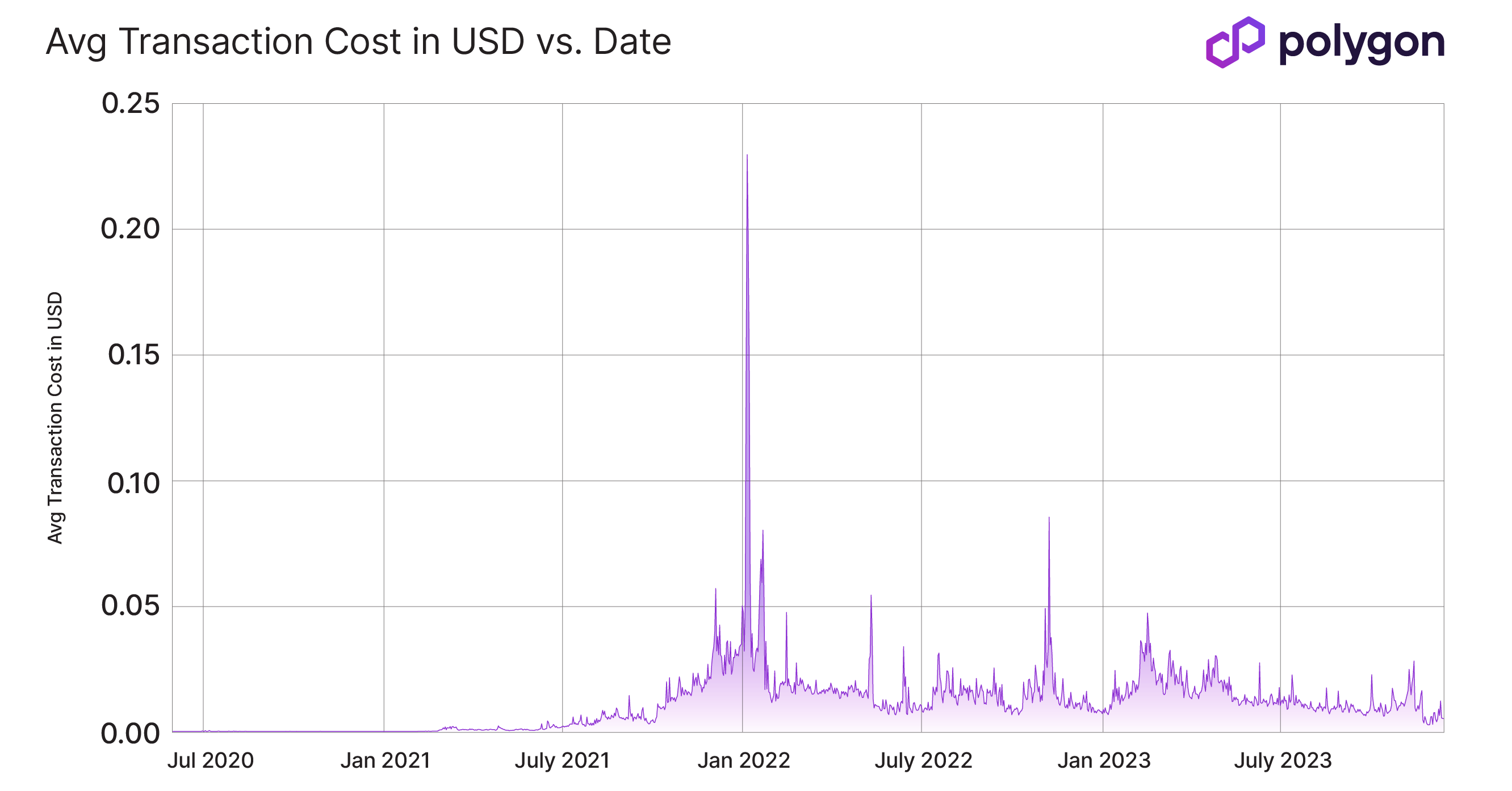

Transaction costs

One of the key advantages of Polygon is its cost-effectiveness. The network has been successful in maintaining transaction costs significantly lower than other chains, often up to 10 times lower. This aspect is crucial for users and developers, especially in a market where high gas fees on networks like Ethereum can be a barrier to entry and usage.

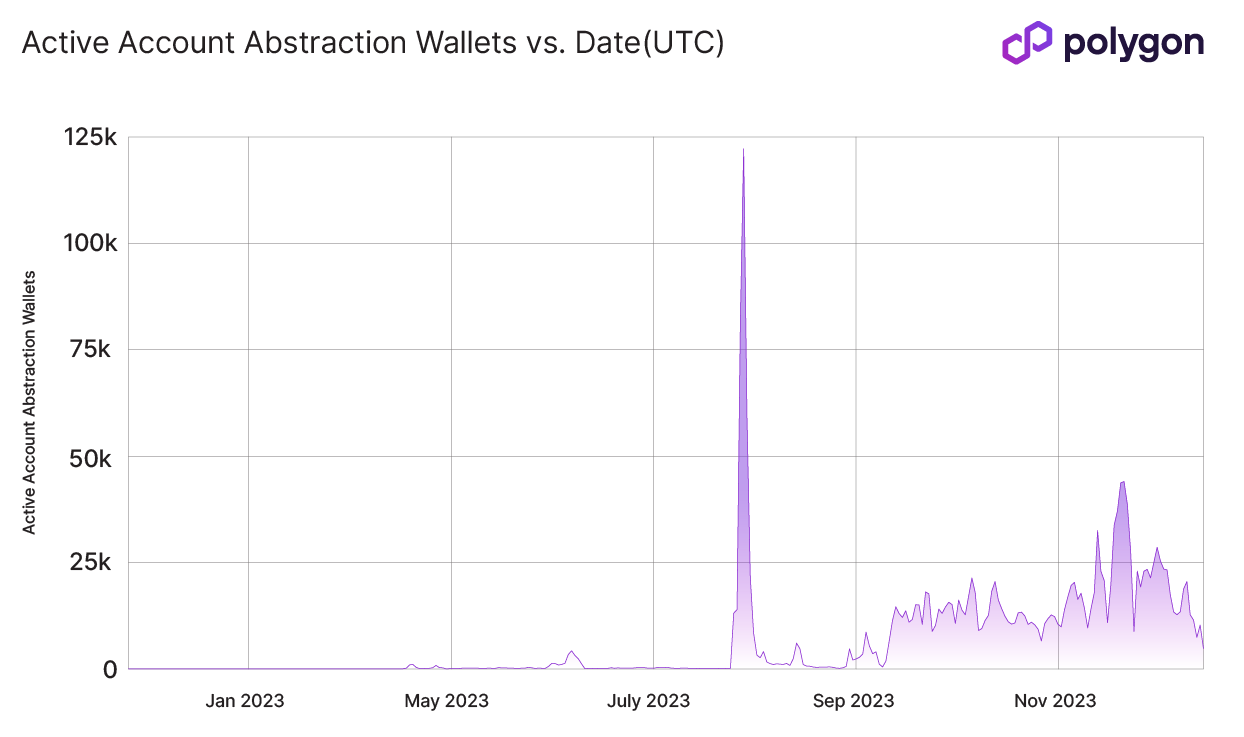

Technical innovations – account abstraction (EIP-4337)

Polygon's integration of EIP-4337 is a major step forward in enhancing user experience. EIP-4337, also known as account abstraction, allows for more flexible management of Ethereum accounts. It enables the creation of smart contract wallets, which can improve security, flexibility, and user-friendliness.

These wallets can support features like batch transactions, flexible security rules, account recovery without seed phrases, multi-factor authentication, and automatic payments. Importantly, EIP-4337 doesn't require alterations to the Ethereum core protocol, making it a favored approach within the community.

AVALANCHE

Avalanche has emerged as an integrative network that plays an important role in aiding Web2 companies in their transition to Web3 technologies. Avalanche has shown remarkable growth in its infrastructure and network activity, marking its position as a facilitator for businesses transitioning into the decentralized space.

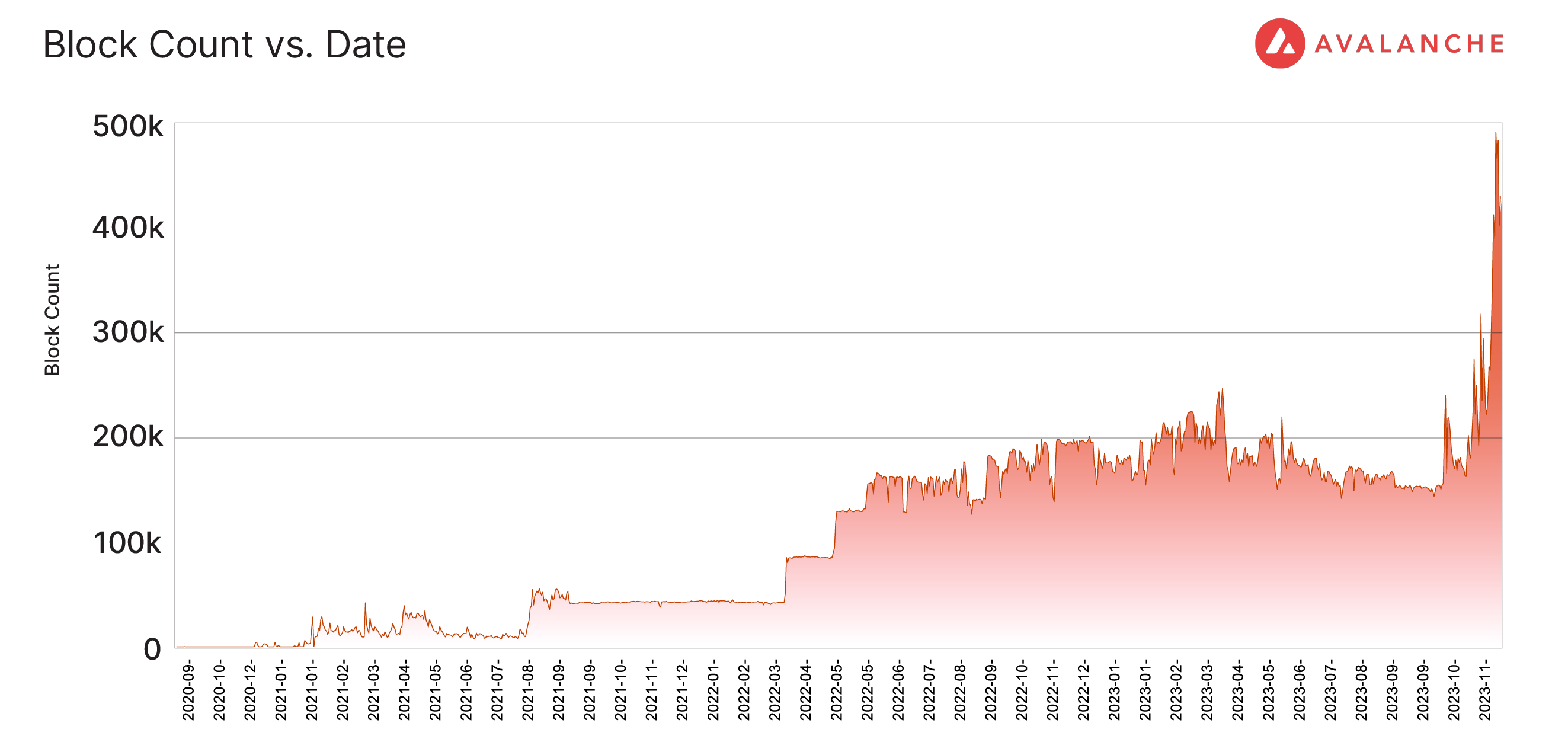

Increase in block processing

Avalanche has seen a 2.5x increase in the number of processed blocks over the year. This significant rise indicates a higher network usage and demand, reflecting an expanding ecosystem and greater adoption.

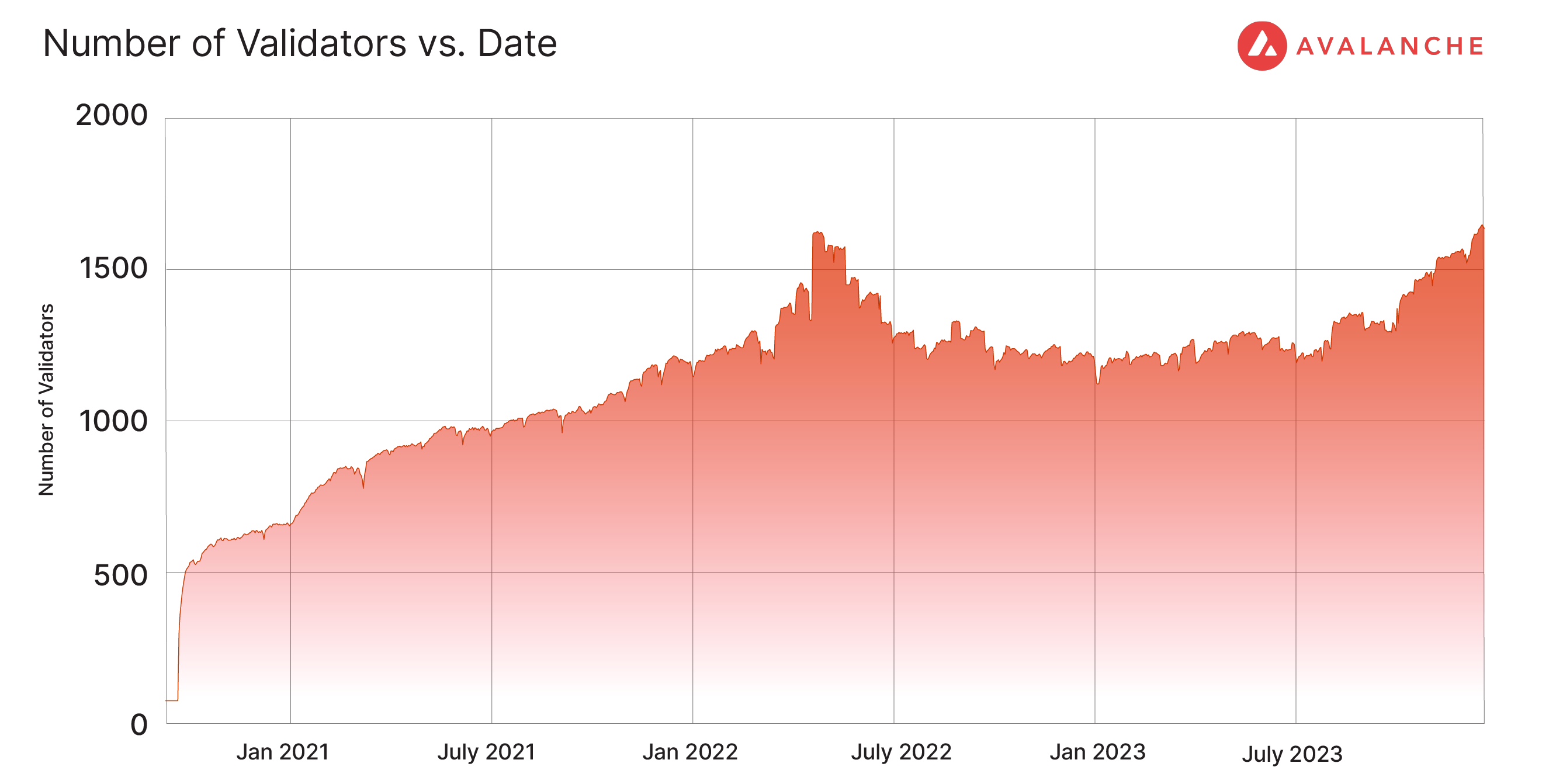

Growth in validator participation

The network has experienced a notable increase in the number of active validators participating in its consensus mechanism. This growth is not just a sign of the network's enhanced security and decentralization, but it also signifies growing trust and investment in the platform's stability and future.

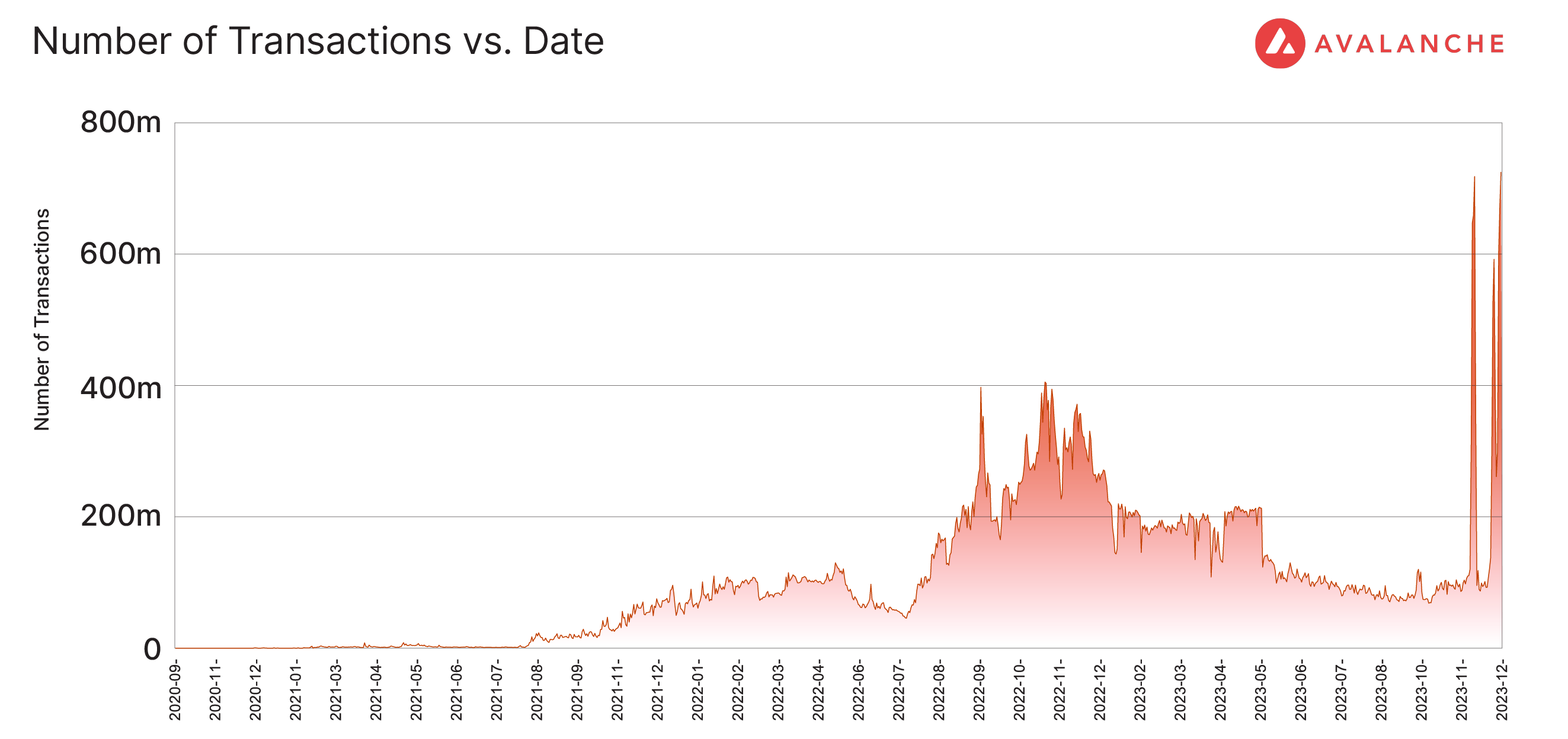

Transaction throughput

There has been a substantial increase in transaction throughput, especially in the last month. This metric is crucial as it represents the network's ability to handle a high volume of transactions efficiently, a key factor for enterprises looking for scalable blockchain solutions.

BNB CHAIN

BNB Chain can handle high-volume on-chain activities, such as processing a high throughput of transactions. Several key metrics reflect its performance and user engagement:

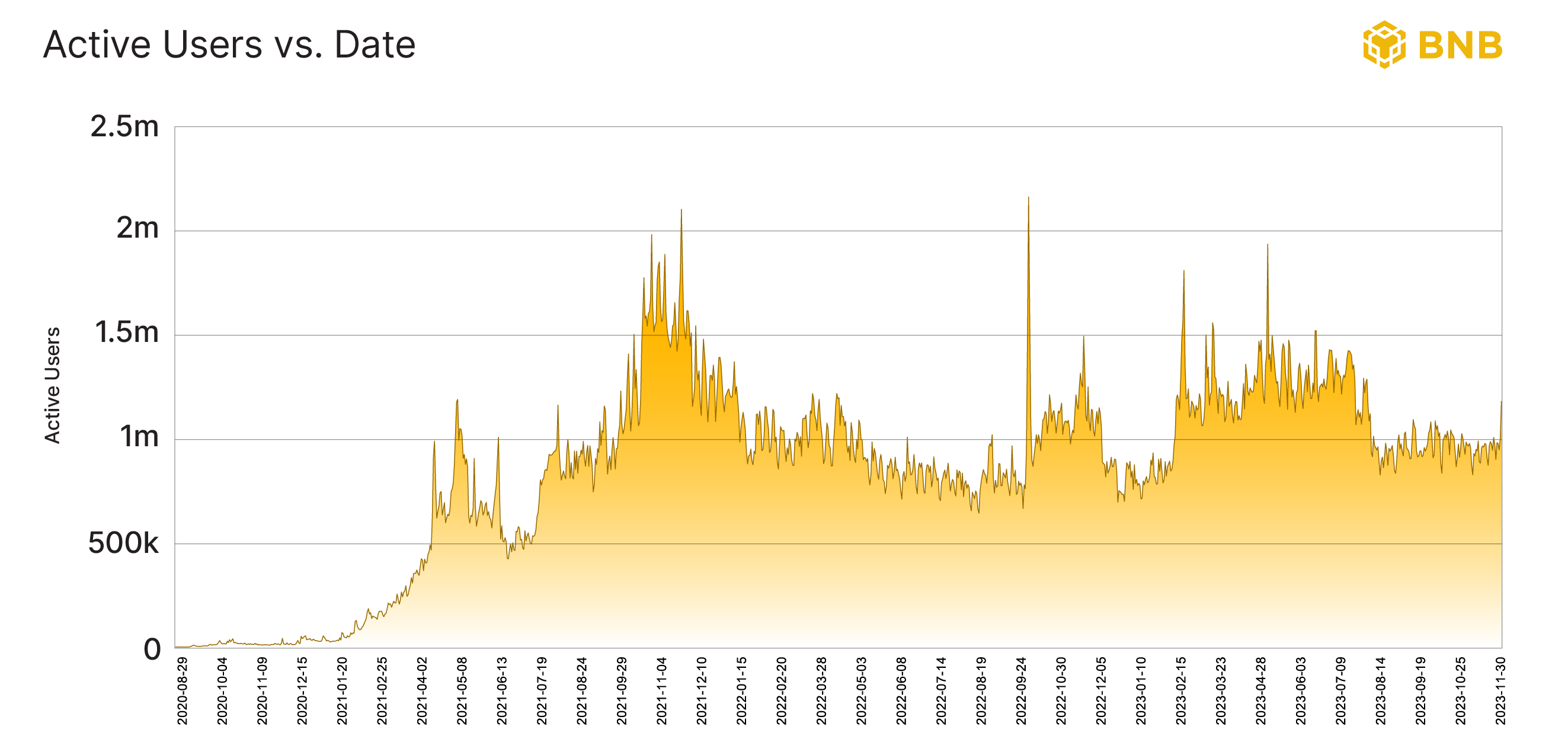

High number of active wallets

The BNB Chain has a significant capacity for user engagement, with daily active wallets peaking at over 2 million. Over the past few months, the network has consistently averaged around 1 million active daily users. This significant level of active participation indicates a thriving ecosystem that successfully caters to a large and diverse user base.

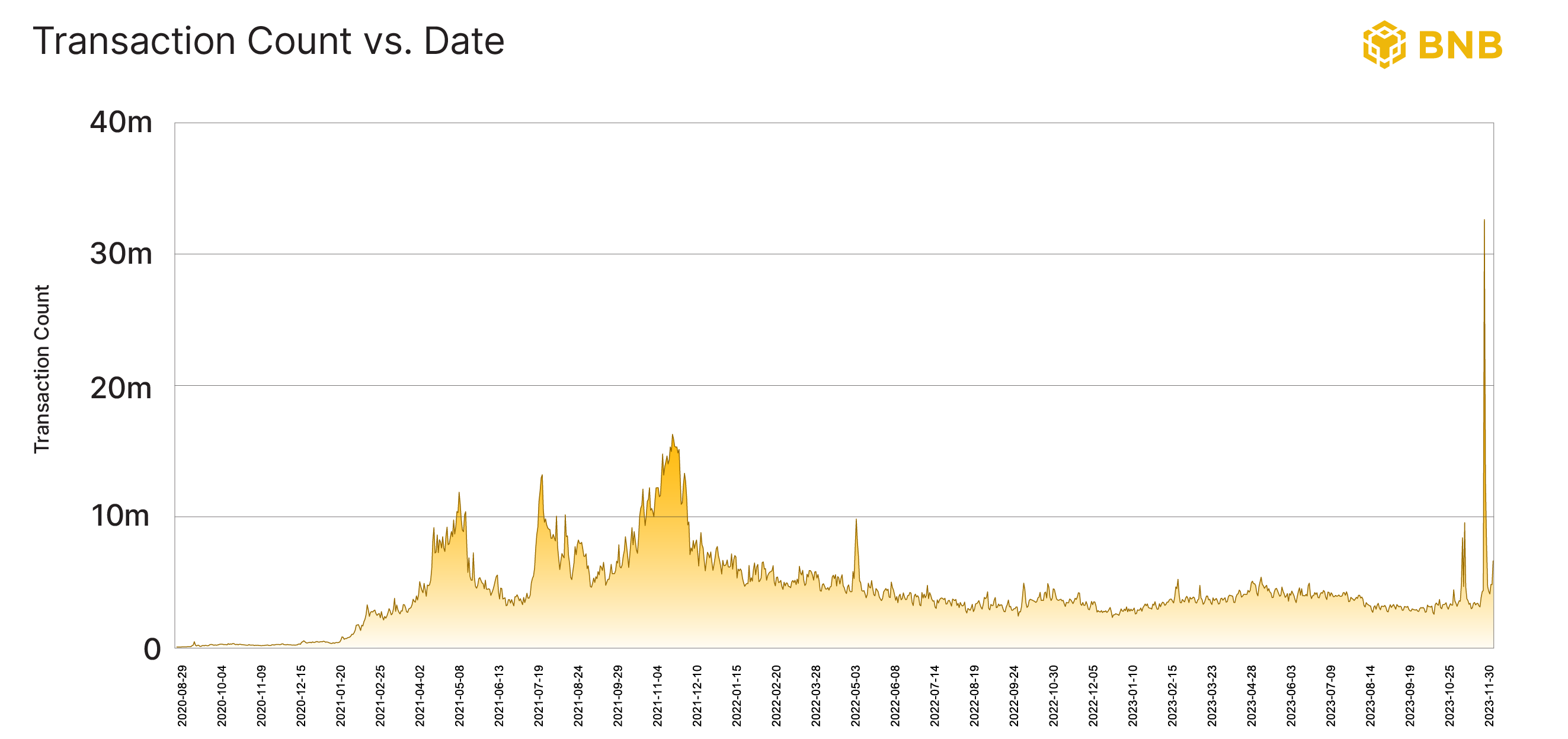

Capability for high transaction volume

Recently, the BNB Chain reached a milestone of over 32 million transactions in a single day. Such a high transaction count indicates the network's robust infrastructure, supporting a vast number of transactions efficiently. Additionally, this metric also demonstrates its scalability and ability to handle large volumes of activity without compromising performance.

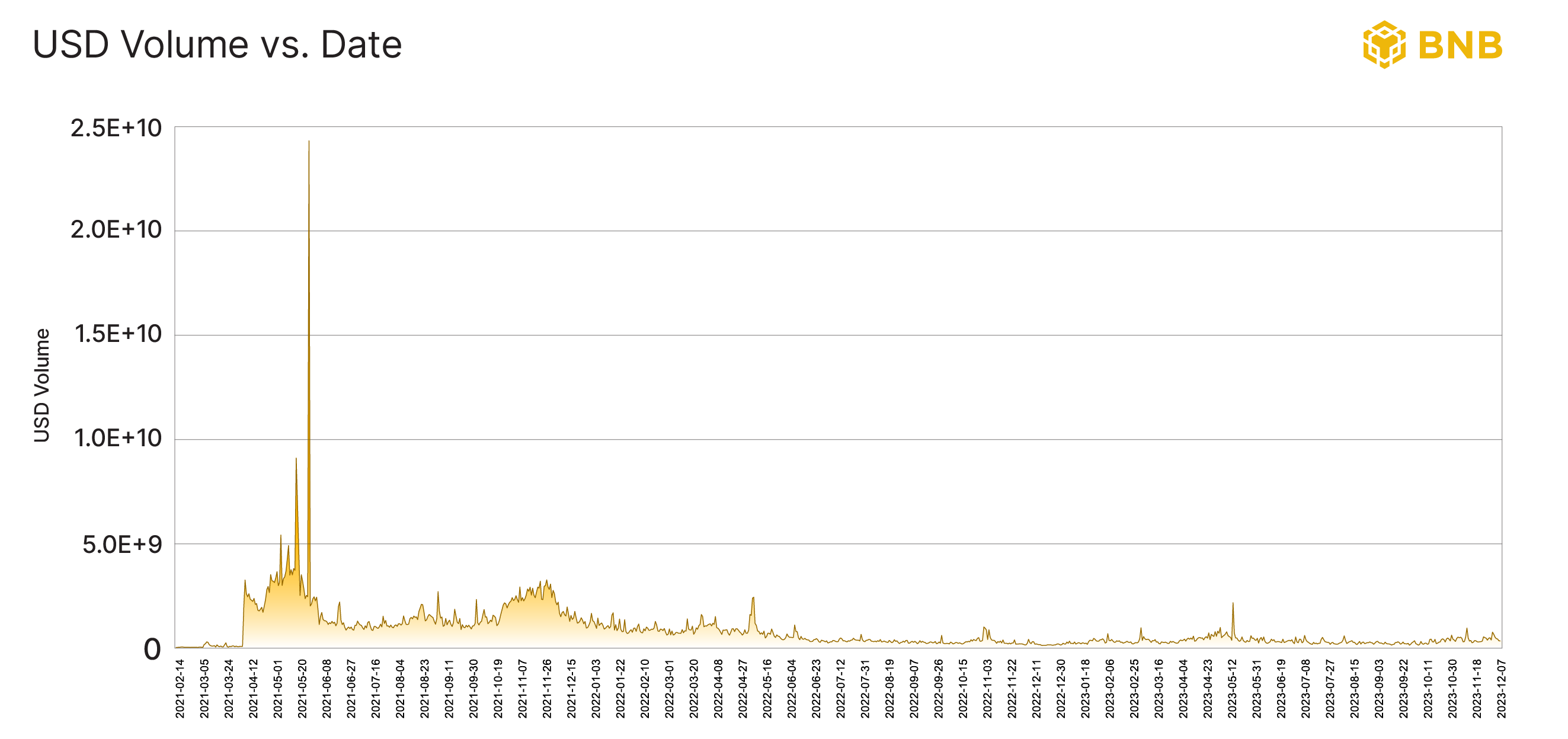

Growing DEX volume

The volume of decentralized exchanges (DEXs) within the BNB Chain has been experiencing growth recently. This increase in DEX volume reflects not only the growing interest and trust in DeFi services but also the network's capacity to support high-volume, complex financial activities. The rise in DEX activity is a positive sign of the network's health and its appeal to both traders and developers in the DeFi space.

BASE

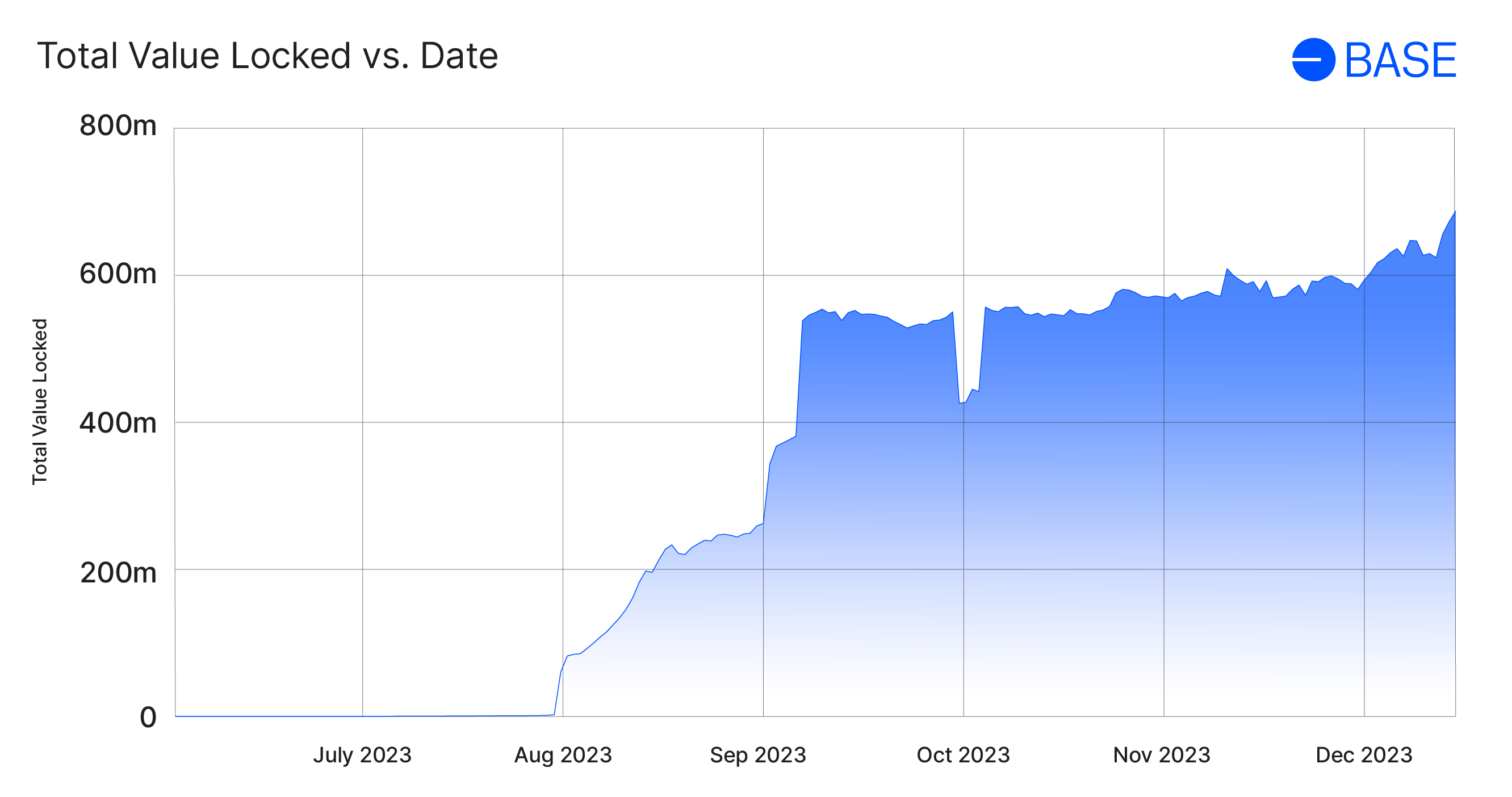

Base Network, a promising Ethereum-focused Layer 2 solution, has rapidly emerged as a significant player in the blockchain ecosystem. Its swift traction and robust development highlight its potential as a leading network in DeFi and the broader Web3 space.

Total Value Locked (TVL)

Base’s TVL amounts to $705 million and shows a consistent upward trend. A high TVL is indicative of a substantial pool of assets being used in the network's ecosystem. In return, this points to strong market confidence and the network's capability to support a variety of decentralized applications and financial protocols.

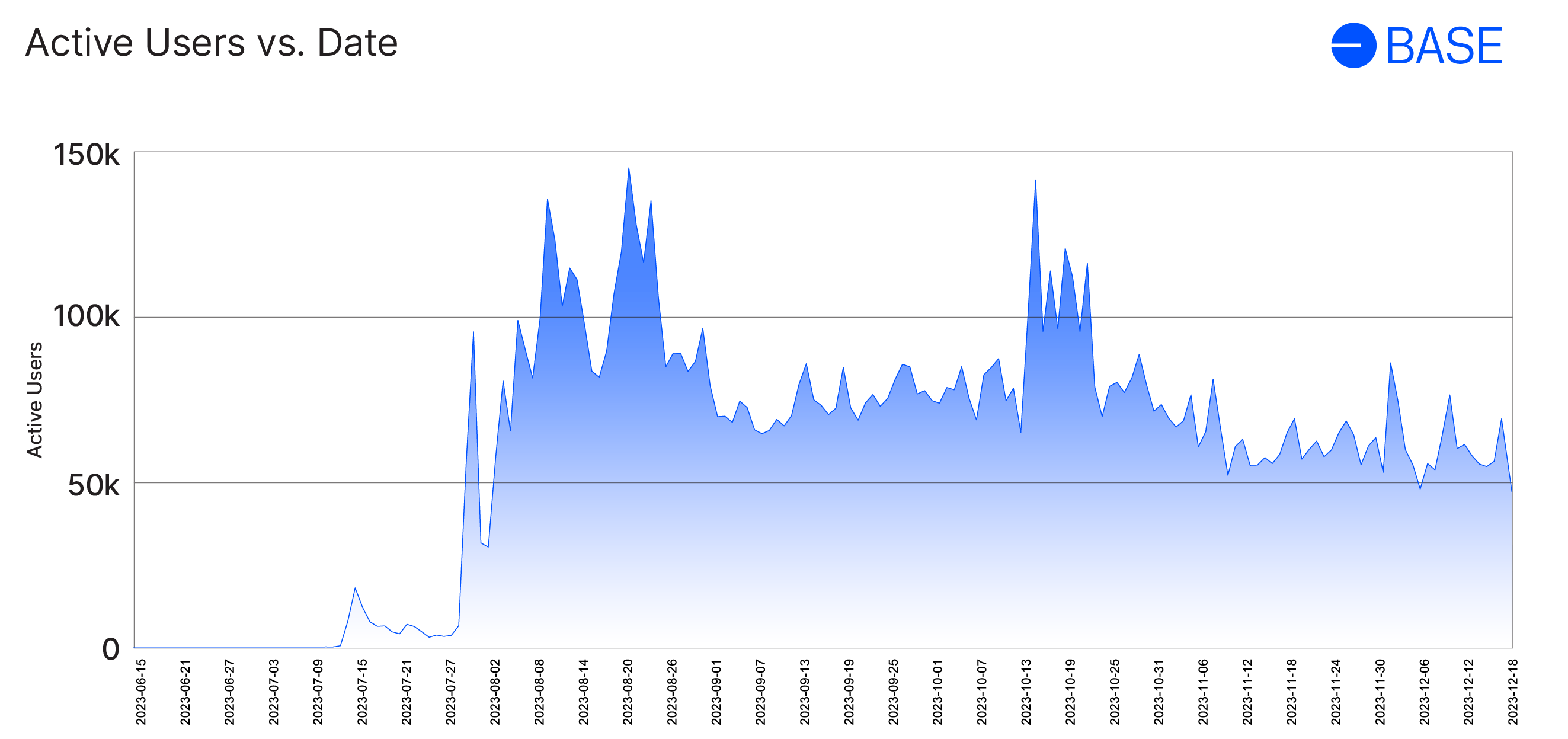

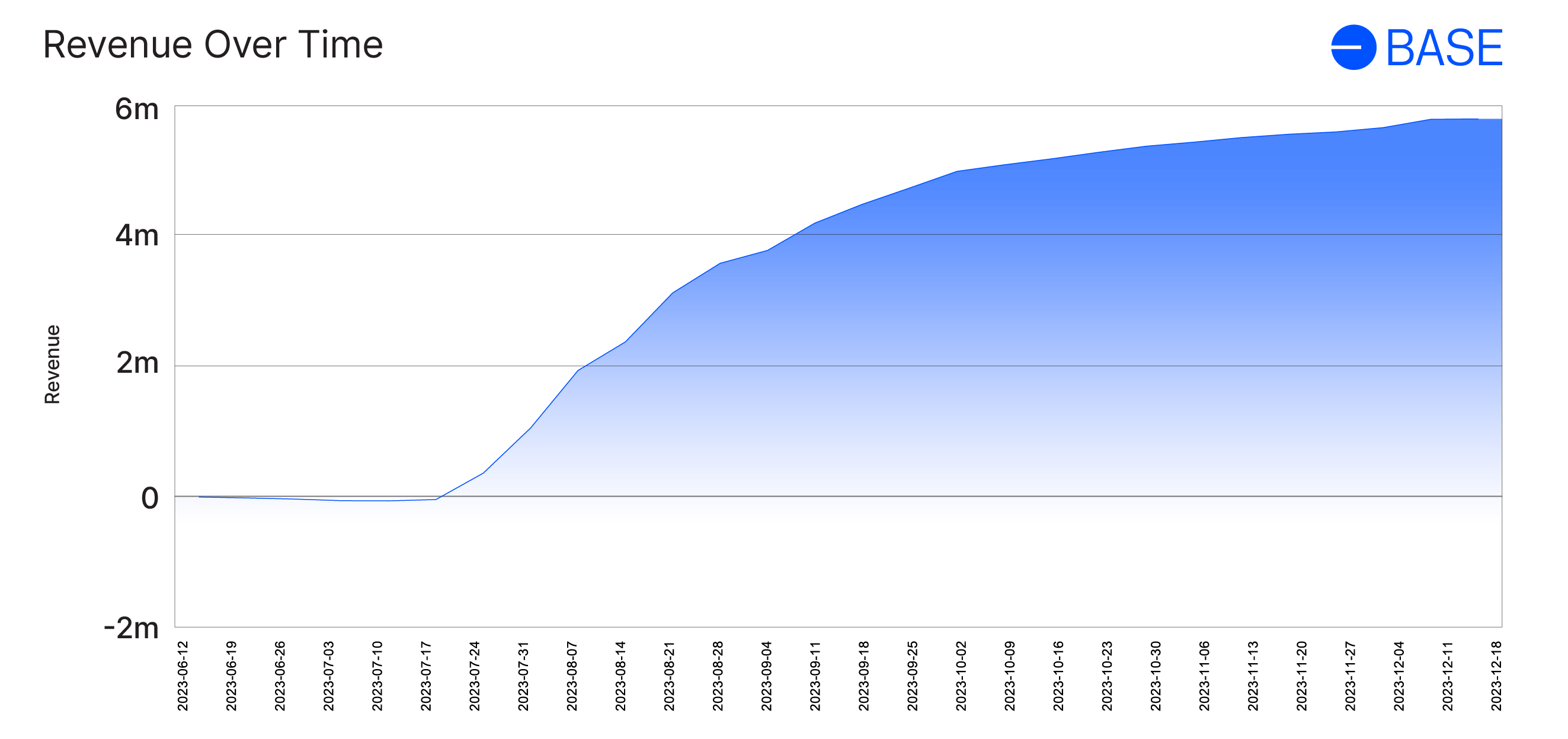

User base retention

This metric reflects the platform's usability, features, and overall appeal. The steady influx of new users, coupled with high retention rates, demonstrates Base's ability to meet and adapt to user needs, contributing to its sustainability and long-term growth. This growing user base is an indication of the network's potential to expand and remain a key player in the industry.

Financial performance

With a profit margin of around 49% and a cumulative revenue exceeding $11 million, Base stands out as one of the most profitable networks. Aside from demonstrating the network's current success, these financial metrics also show its operational efficiency and the effectiveness of its business model. High profitability and substantial revenue are clear indicators of a well-implemented strategy.

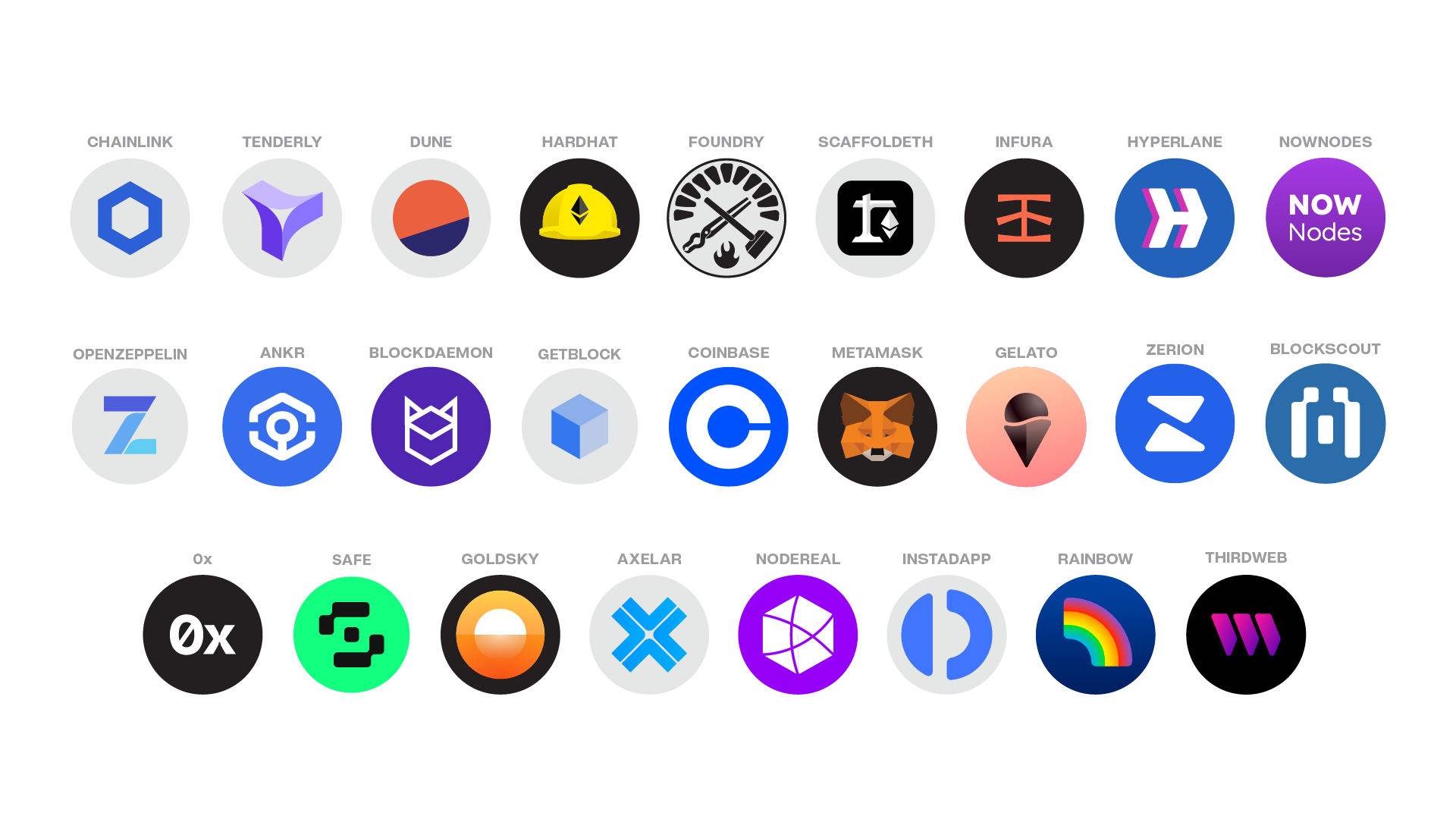

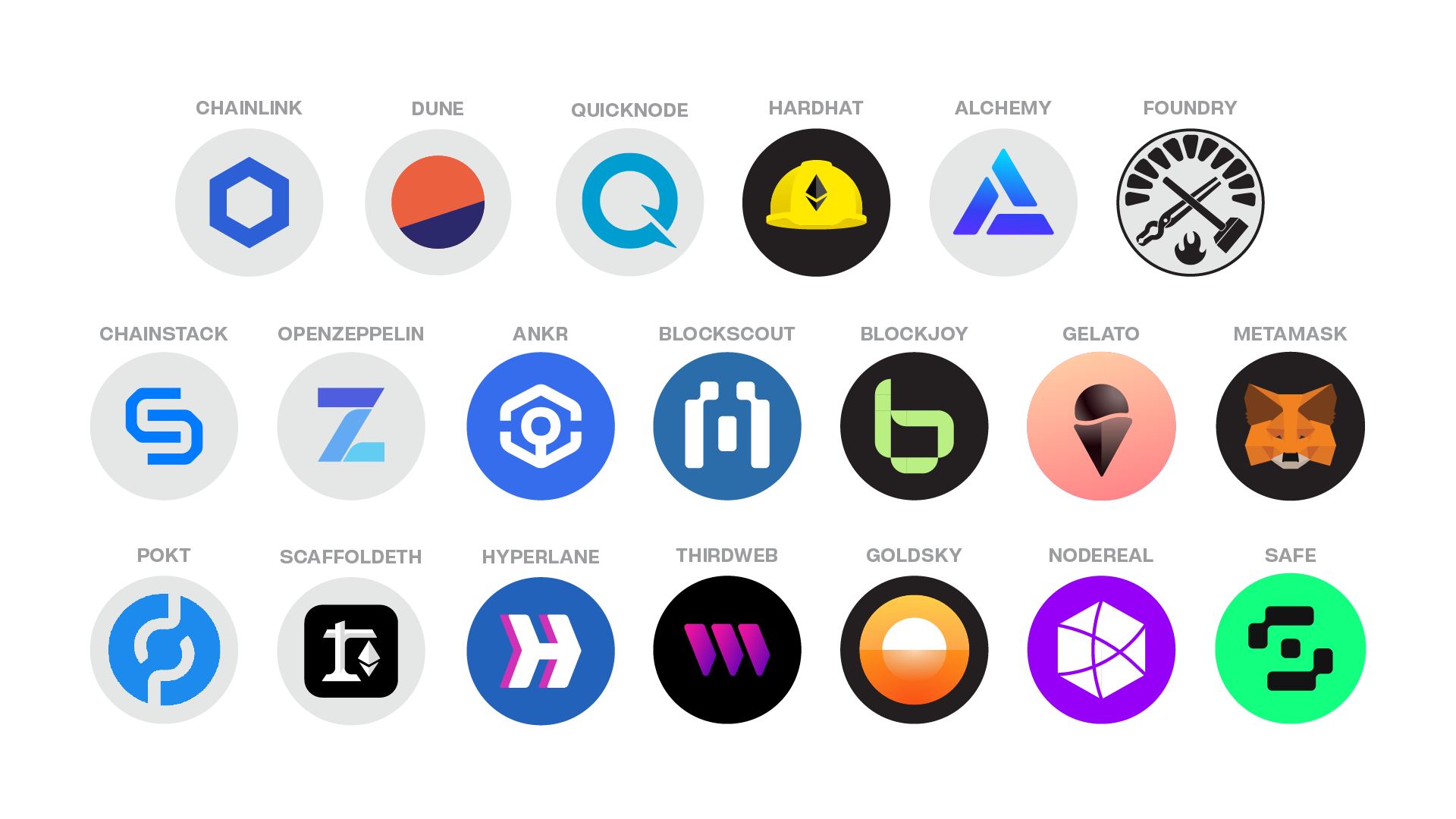

Tooling support for ecosystem networks & L2 and appchain tech stacks

Seamless tooling availability and portability between these chains help overcome the fragmentation typical of blockchain development that’s even more obvious in the multichain landscape. Additionally, with the same or at least a similar set of tools on these networks, dapp developers can navigate the multichain ecosystem more easily.

|

|

|

|

|

|

|

|

|

|

|---|---|---|---|---|---|---|---|---|---|

| Chainlink | |||||||||

| The Graph | * | * | |||||||

| Tenderly | |||||||||

| Dune | |||||||||

| Hardhat | |||||||||

| Alchemy | |||||||||

| Foundry | |||||||||

| Scaffoldeth | |||||||||

| Infura | ** | ||||||||

| Quicknode | |||||||||

| Chainstack | |||||||||

| OpenZeppelin | |||||||||

| Moralis | |||||||||

| Ankr | |||||||||

| Blockdaemon | |||||||||

| Blockscout | |||||||||

| Blockjoy | |||||||||

| Getblock | |||||||||

| Pokt | |||||||||

| Allnodes | |||||||||

| Nownodes | |||||||||

| 0x | |||||||||

| Thirdweb | |||||||||

| Enso | |||||||||

| Goldsky | |||||||||

| Axelar | |||||||||

| NodeReal | |||||||||

| Hyperlane | |||||||||

| Coinbase | |||||||||

| Instadapp | |||||||||

| Rainbow | |||||||||

| MetaMask | |||||||||

| Safe | |||||||||

| Phantom | |||||||||

| Zerion | |||||||||

| Gelato |

** Base is only available privately to a limited number of customers.

Top 3 tech stacks and tooling support for L2s and appchains

As the three most widely used tech stacks for launching new chains, OP Stack, Polygon zkEVM, together with its CDK, and Avalanche Subnets offer ready-made but customizable components that allow network developers to create new scalable chains in a streamlined way.

OP STACK

The OP Stack is a standardized and open-source development stack consisting of various software components and tools. It’s widely used across Ethereum and Optimism ecosystems to power environment and application-specific chains. Thanks to its modular components, the OP Stack is highly scalable, simplifying the creation of new chains.

Many different projects use the OP Stack, including Manta Pacific, an optimistic rollup chain ($31.50M TVL), Aevo Open Mainnet, a decentralized options exchange ($11.85M TVL), and Zora, an L2 appchain that supports artistic expression on-chain. ($9.21M TVL).

New projects using the OP Stack are also upcoming. These include Lyra, an L2 solution for the Lyra protocol, Metal, an L2 solution by Metallicus, and Mode Network, an L2 made for users and builders.

POLYGON zkEVM

Polygon zkEVM is another popular scaling solution in the ecosystem that inherits security from Ethereum Mainnet. It offers reduced transaction costs and increased transaction throughputs thanks to the use of zk-proofs, while also ensuring a better experience for the end user.

With open-source, modular software components, Polygon CDK enables the launch of scalable L2 solutions based on Polygon zkEVM. Some of the upcoming projects built using zkEVM include Astar zkEVM, an Ethereum Layer-2 scaling solution, Canto, an L1 chain migrating to L2, and Capx, a sector-specific L2 for token distribution and trading. Immutable zkEVM is another chain powered by Polygon zkEVM intended for gaming applications.

Polygon’s zkEVM allows developers to easily port the existing Ethereum tooling and infrastructure components to a new L2 solution, without making significant code changes.

AVALANCHE SUBNETS

Avalanche Subnets are sovereign networks with a dynamic subset of validators that secure and validate Subnet chains. Subnet-powered chains can have their own rulesets, execution logic, security, state maintenance, and fee systems.

Subnets enable network developers to create chains with custom EVMs. However, they can also be deployed with Subnet EVM, which is EVM-compatible and supports existing Ethereum smart contracts and tooling.

Some of the Subnet-powered projects include Beam Subnet, a chain built specifically for gaming use cases, Cloudverse Subnet, a network containing all the Cloudverse enterprise metaverse data, and DFK Subnet, a network striving to become a go-to solution for GameFi and other blockchain gaming applications.

Building the multichain future together

With an increasing number of L2 solutions and appchains, as well as growing communities on the existing scaling solutions, it’s evident that the blockchain ecosystem is going multichain. However, while the multichain future benefits Ethereum’s scalability and fosters further growth and innovation, it also brings an additional level of complexity and fragmentation.

Ensuring tooling portability across EVM chains and streamlining new chain deployments is essential in overcoming these challenges. Together, network developers, rollup providers, tooling vendors, and infrastructure providers can remove friction in onboarding new developers, support network adoption, and realize the potential of blockchain technology.

Legal disclaimer

This report contains data that is for informational purposes only and is not intended to provide financial or legal advice. The information is based on our internal sources and network analysis. However, it also contains information collected from publicly available resources for which we cannot guarantee completeness or accuracy. We strongly advise you to conduct your analysis and research as this report does not assure any future results or performance.